When Stan Kroenke took a 10 per cent equity stake in Arsenal in 2007, he was buying into English football’s original self-sufficient club with a clear financial vision.

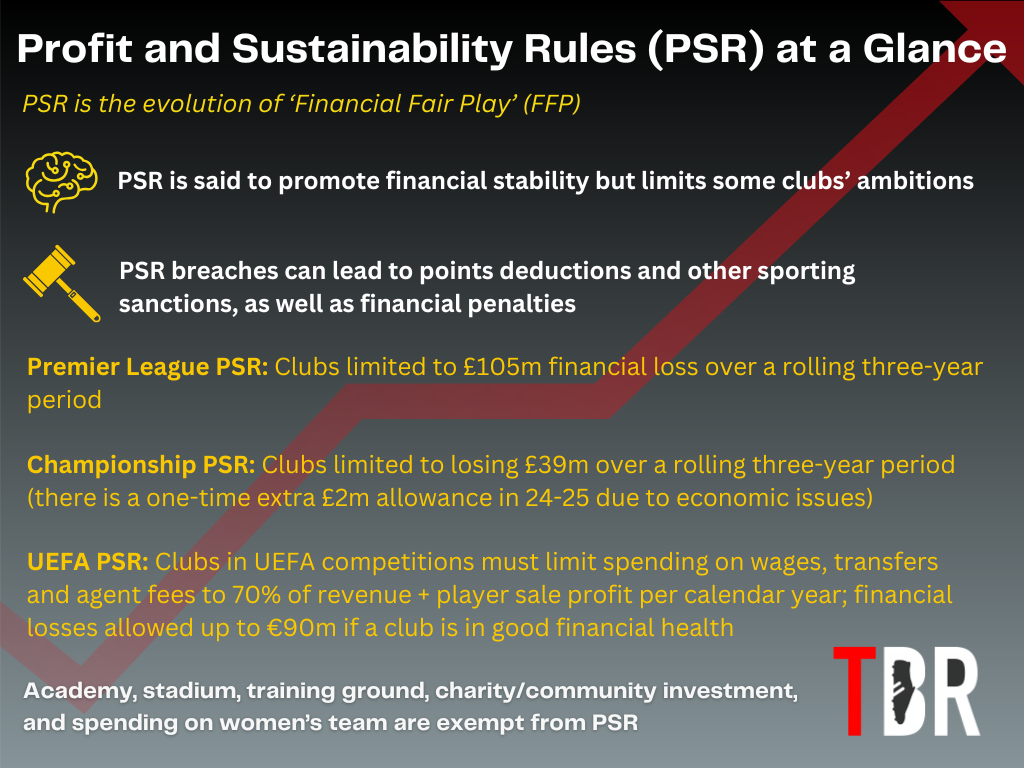

Back then, English football operated under the law of the jungle. There were no Profit and Sustainability Rules (PSR), no state-owned clubs, and enterprise values were measured in millions, not billions.

Arsenal had just moved into the Emirates Stadium, which they projected would allow them to self-fund, generate surpluses, and remain competitive on the pitch.

Photo credit: Serena Taylor/Newcastle United/Getty Images

It was a business model that was virtually unprecedented at the time. Profits have always been thin in football finance and risk is inherent in the structures of the game.

A few investors over the years thought they could outsmart the history books, do what so few have, and turn over regular profits. However, in most cases, clubs were seen more as trophy assets in most cases.

But Stan Kroenke had the know-how in US franchise sport and was convinced he could implement the same commercially-geared model in North London.

| Franchise | Sport | Major Honours in Kroenke era |

| Los Angeles Rams | NFL (American Football) | 1x Super Bowl Champion (2021) |

| Denver Nuggets | NBA (Basketball) | 1x NBA Champions (2023) |

| Colorado Avalanche | NHL (Ice Hockey) | 2x Stanley Cup Champions (2001, 2021–22) |

| Colorado Rapids | MLS (Football) | 1x MLS Cup Champion (2010) |

| Colorado Mammoth | NLL (Lacrosse) | 2x NLL Champions (2022, 2024) |

Kroenke eventually won the decade-long power struggle with Alisher Usmanov and took 100 per cent control of the club in 2018.

Between his first investment in 2007 and that date seven years ago, Arsenal made total profits over almost £350m. There was just one problem – they barely won anything.

There had been a space race in the transfer market. Clubs got high on the fumes of the Premier League’s goliath TV deal and spent wildly to compete with Roman Abramovich and Sheikh Mansour’s wealth.

Football inflation was out of control and clubs who weren’t particularly bothered about a financial return on investment had left Arsenal in their dust, despite Kroenke being – on paper – the richest of the lot.

| Name | Rank in top 500 | Net worth | Club(s) |

| Bernard Arnault | 4 | $189B | Red Star FC (France) |

| Mark Mateschitz | 80 | $23.4B | Red Bull clubs |

| Stan Kroenke | 85 | $22.8B | Arsenal, Colorado Rapids |

| Philip Anschutz | 86 | $22.8B | Los Angeles Galaxy |

| David Tepper | 87 | $22.4B | Charlotte FC |

| Francois Pinault | 90 | $22.1B | Stade Rennais |

| Dietmar Hopp | 112 | $18.4B | 1899 Hoffenheim |

| Jim Ratcliffe | 200 | $12.4B | Man United, Nice, Lausanne |

| Hansjoerg Wyss | 218 | $11.9B | Chelsea, Strasbourg |

| Josh Harris | 224 | $11.7B | Crystal Palace |

| Simon Reuben | 227 | $11.5B | Newcastle United |

| David Reuben | 228 | $11.5B | Newcastle United |

| Dmitry Rybolovlev | 246 | $11.1B | AS Monaco |

| Mark Walter | 252 | $10.9B | Chelsea, Strasbourg |

| Dan Friedkin | 253 | $10.9B | AS Roma, AS Cannes, Everton |

| Shahid Khan | 307 | $9.33B | Fulham |

| Nassef Sawiris | 324 | $8.95B | Aston Villa, Vitoria |

| Daniel Kretinsky | 402 | $7.69B | West Ham, Sparta Prague |

| Joe Lewis | 405 | $7.66B | Tottenham |

| Todd Boehly | 426 | $7.28B | Chelsea FC, Strasbourg |

Arsene Wenger coined the term ‘financial doping’ as rival clubs parlayed heavy losses for silverware. It was a tactic admission that the Gunners could not compete while their existing finance model remained.

So Kroenke changed course.

Photo credit: Stuart MacFarlane/Arsenal FC/Getty Images

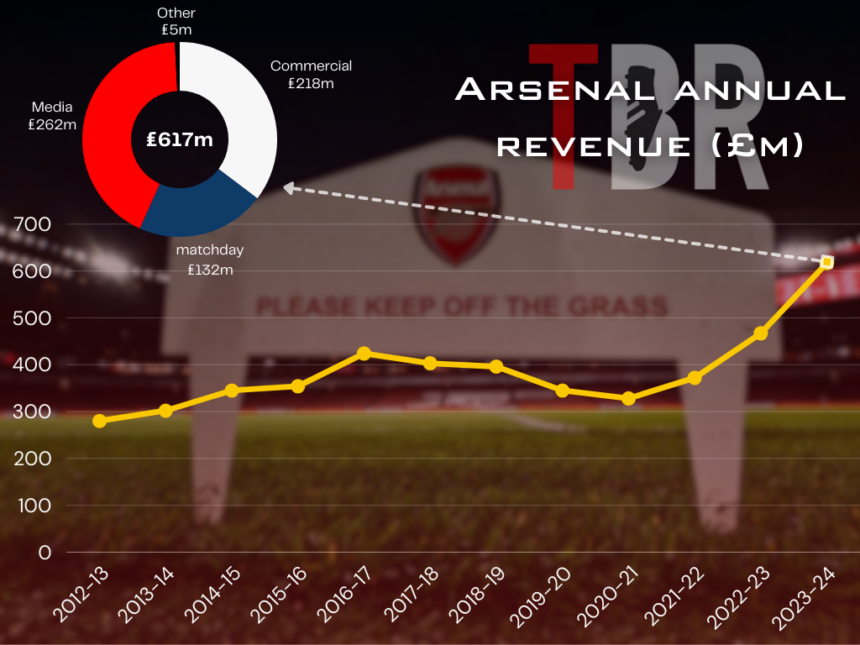

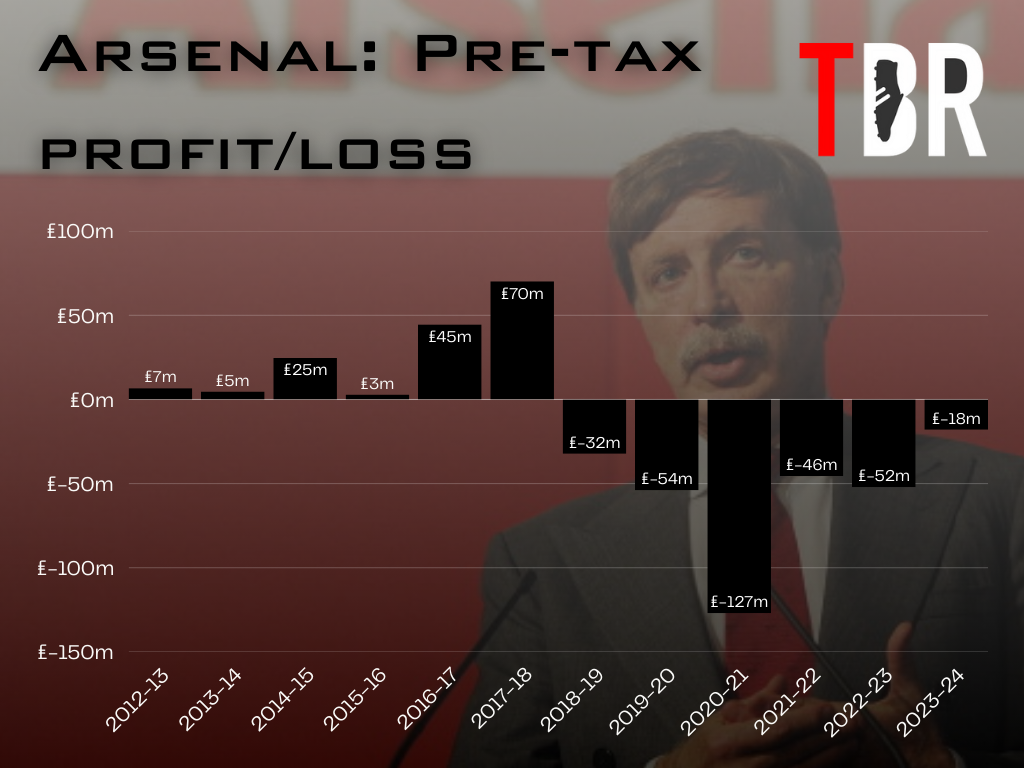

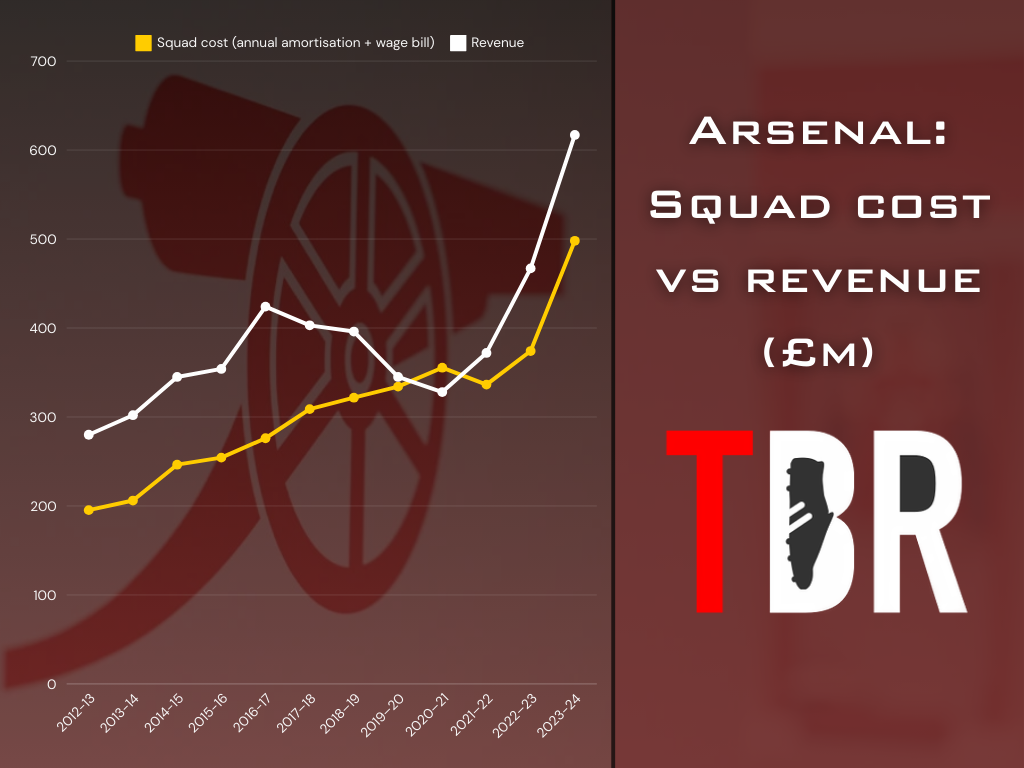

From 2018 to the present day, Arsenal’s financial losses have reached almost £330m, partly due to largely stagnant revenue and absence from the Champions League, but also because of increased investment.

Arsenal have broken their transfer record eight times since that financial year, and their wage bill and player amortisation have both reached new heights since their return to European football last season.

Photo by Alex Burstow/Arsenal FC/Getty Images

At some point, however, Kroenke will want regular profits once more and, as Liverpool University football finance lecturer Kieran Maguire explains in conversation with TBR Football, to sell at a huge markup.

Arsenal valued at £3bn

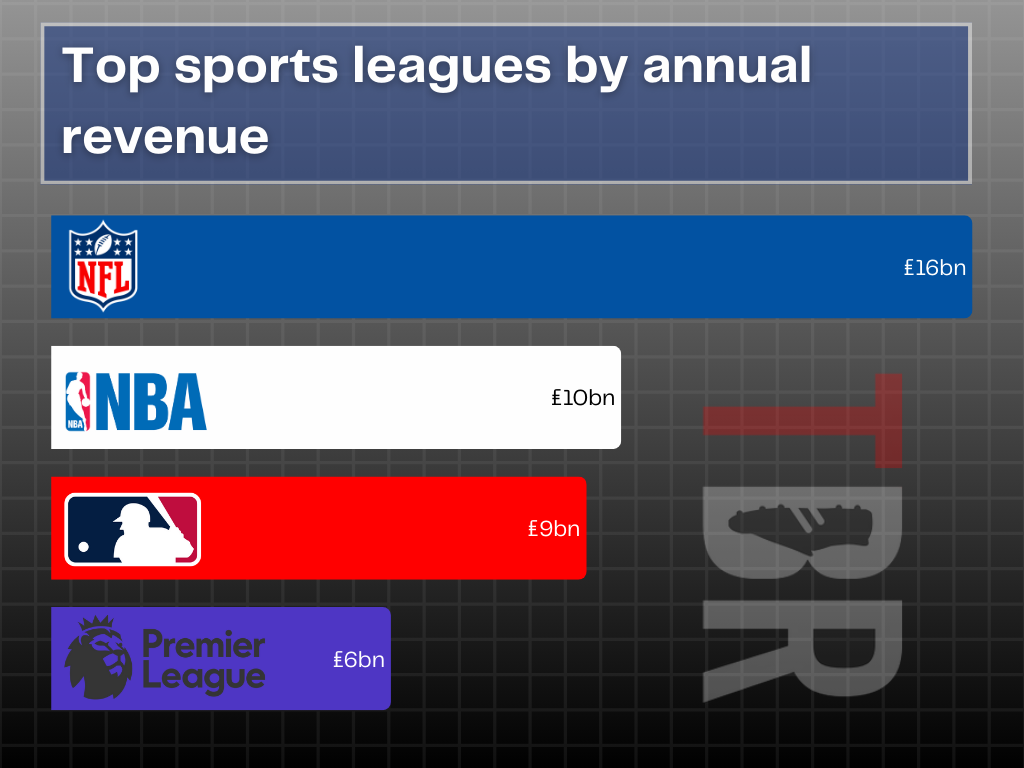

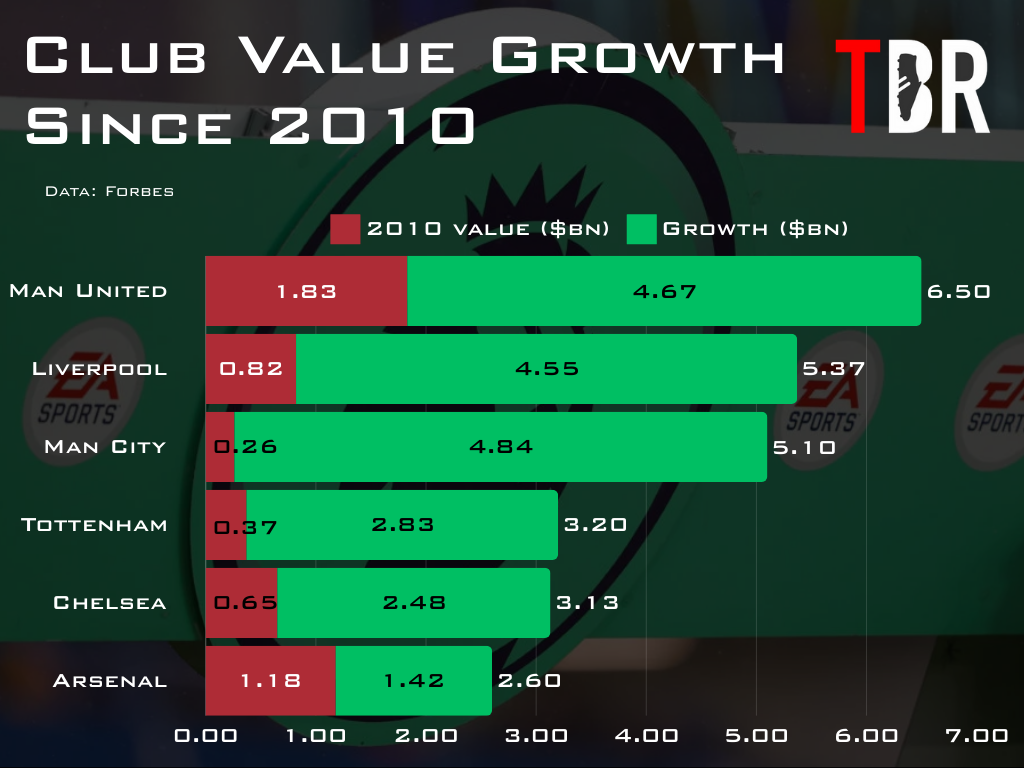

Each year, Sportico publishes a list of sport’s top 100 most valuable franchises. Arsenal are one of just six football clubs to make the cut this year, which is dominated by the NFL, NBA, MLB, and NHL.

The Gunners are appraised at £3bn in the list, which makes them the world’s 67th most valuable team.

Significantly, the Kroenke Sports & Entertainment empire is valued at £12bn and is the only ownership group to have three franchises in the top 100.

Man United’s Glazer family, Liverpool owners FSG, and Chelsea’s new regime all have two in the list.

Football finance expert explains Stan Kroenke’s takeover masterplan

Kroenke’s Los Angeles Rams (NFL) and Denver Nuggets (NBA) both rank higher than Arsenal in Sportico’s list by virtue of the closed-shop, franchise systems in which they operate.

In the NFL and NBA, profits are guaranteed, costs are capped and their is a collaborative approach to business. The two leagues are the most effective money-printing machines in sports.

Credit: Adam Williams/TBR Football/GRV Media

At Arsenal, it’s very different. Profit is far from guaranteed, as the last seven years have shown. So where does the £3bn value come from?

According to Kieran Maguire, Kroenke’s plan is to sell the club and he will make his returns at the exit door. This is a ‘capital appreciation’ model.

“American franchise sports are completely de-risked,” says the Price of Football author and podcast host, speaking exclusively to TBR.

“First of all, you have the non-existence of relegation. Secondly, there is no equivalent of failing to get into the Champions League, which makes revenue volatile.

“If you look at franchise sports, you have the draft system. That gives them a trampoline. That doesn’t exist in football. Therefore, what you find is far greater pressure to spend to compete than there is in the US.

“The collective bargaining agreements in the US are, to a certain extent, tilted towards the owner. Over there, for example, players get something like 48 per cent of revenue. In the Premier League it is far higher.

“All of those factors are culturally very different, and there is a third issue in that, if you are an NFL player, there is no alternative league to go and play in.

“In football, you can play in London, Madrid, Milan etc. You also have the opportunities that the Saudi Pro League and other markets offer too. None of that exists in the NFL, where it’s United States or nowhere.

“Those advantages that exist for Kroenke in the US don’t exist in football, so he has to accept through gritted teeth that the year-on-year profits that he enjoys in the US don’t exist in the Premier League.

Photo by James Gill/Danehouse/Getty Images

“Instead, the financial benefits are upon exit rather than in the ownership itself. Its a collective in the NFL and NBA, where everything is geared towards profit.

“In European football, you have a mix of cultures – there are profit maximisers versus utility maximisers, and they don’t go well together.”

KSE can easily absorb financial pressure in US as £217m NFL salary cap confirmed

While costs will never exceed revenue in Stan Kroenke’s other sports ventures – not by a long shot, in fact – the margin between turnover and expenditure is sometimes squeezed.

Last week, for instance, the NFL raised the salary cap to which Kroenke’s LA Rams will be subject by around £18m to £218m.

“The increase in the NFL salary cap is not significant to Kroenke in the context of his wealth,” says Maguire, analysing the wider business health of the KSE empire and Arsenal’s place within it.

“The reason is that NFL clubs traditionally spend less than half of their revenue on wages. Players are only being paid wages for five or six months per year. For the rest of the year, the club doesn’t pay them.

“Therefore, on the back of that, they tend to be extremely successful in cash generation thanks to the size of the NFL TV deal with US broadcasters in particular.

“They are very cash generative, so they can easily absorb a little bit more money to the players. It’s more than covered by extensively higher increases on cash flows from TV, ticket sales and commercial partners.”

Tim Lewis protects Arsenal’s position in face of regulator threat

Traditionally, a culture of free market dogma underlies the US business sphere. But in sport, America is paradoxically more restrictive in terms of caps and collective bargaining than is the case in Europe.

The imminent independent regulator for English football, which has cross-party support but is opposed almost universally within the Premier League, could change that.

The government-backed regulator will have backstop powers to introduce new financial distribution mechanisms and – potentially – change the game’s spending rules.

Recent reports have suggested that the regulator could impose fines as high as 10 per cent of revenue for clubs who breach its rules, which for Arsenal would be almost £62m.

Tim Lewis, Arsenal’s vice-chair and Stan Kroenke’s most trusted advisor at the Emirates, has been one of the public faces of the opposition to the regulator.

But that is not because they fear they could breach spending rules, according to Maguire: “Arsenal are in a very strong PSR position.

“They have relatively little to worry about with regards to any form of financial penalties coming from a regulator.

“From what we can see, the regulator doesn’t want to get involved in the operational, day-to-day activities of clubs.

“Arsenal are generating a PSR profit each year when you take into consideration their investment in infrastructure, the women’s team and the academy.

“Therefore, there is little to worry about from their point of view at present.”

Has Stan Kroenke spoken to Super League 2.0 organisers?

In April 2021 when Arsenal were forced to drop out of the European Super League in response to a furious backlash from fans, Kroenk had to redesign his business plans overnight.

If KSE had taken them into a closed-shop Super League with a £2.7bn prize pot, profits would be guaranteed for the Gunners and their enterprise value would have exploded.

Now, the Super League has returned. A22 Sports Management, the firm funded by Barcelona and Real Madrid to resurrect the breakaway competition, unveiled the ‘Unify League’ late last year.

Arsenal’s position is that they have not entertained any advances from A22 since 2021, when they were sent the clearest of messages by their supporters whose collective will helped the competition’s collapse.

However, A22 CEO Bern Reichart has said he has had conversations with 10 English clubs, many of whom are actively interested in joining the new competition, which they hope will replace the Champions League.

Reichart has also insisted that while many clubs have distanced themselves from the project publicly, it is a very different story behind the scenes.

Stan Kroenke proved that he has little reverence for social importance of sport to fans when his relocated the Rams from St Louis to Los Angeles in 2016.

Many analysts believe that this is why an independent regulator with the power to block attempts to join breakaway leagues, stadium and badge changes, and other measures is so important.