In April 2021, everything changed for Fenway Sports Group. Liverpool’s owners were forced to rip up their grand vision for the club and write a whole new business plan.

For at least five years prior to the launch ,TBR Football has routinely been told that FSG were the driving force behind the European Super League plot in tandem with arch-rivals Manchester United.

John Henry attended dozens of secret dinners, commissioned clandestine PR drives to gauge the public and financial sphere’s appetite, and plunged countless man hours and dollars into the breakaway project.

But within 48 hours, Liverpool’s shameful scheme collapsed. FSG instantly went into damage control mode, with Henry giving an emasculating apology to fans whose faith in the club and sport was shaken.

However, their concern was not for the bedrock supporters that make Liverpool great – and whose passion FSG trade on in talks with sponsors, corporate clients, and merchandisers – but rather their own value chain.

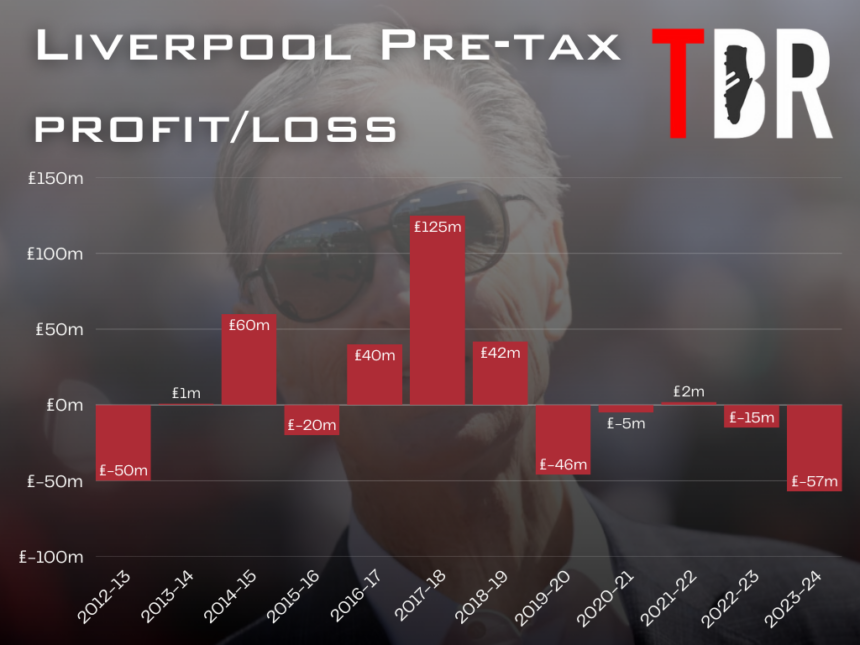

Premier League clubs are barely profitable.

Liverpool under the Boston-based ownership have been one of the best at generating surpluses, but those profits are tiny relative to FSG’s teams in Major League Baseball and the National Hockey League.

Without a closed-shop, US franchise sport-style Super League wherein profits would be guaranteed and revenue volatility removed from the equation, where was the value in owning a football club for FSG?

“Put it this way – they don’t want to be standing in the Kop singing You’ll Never Walk Alone.“

– Kieran Maguire, speaking to TBR Football

FSG don’t take dividends or management fees from Liverpool. They have invested hundreds of million to redevelop Anfield and the training centre, with no financial return as yet.

The Super League was meant to be the quantum leap that would allow them to actually make money. With the project dead, it was no great surprise to see FSG put the club on the market 18 months later.

Credit: Adam Williams / GRV Media

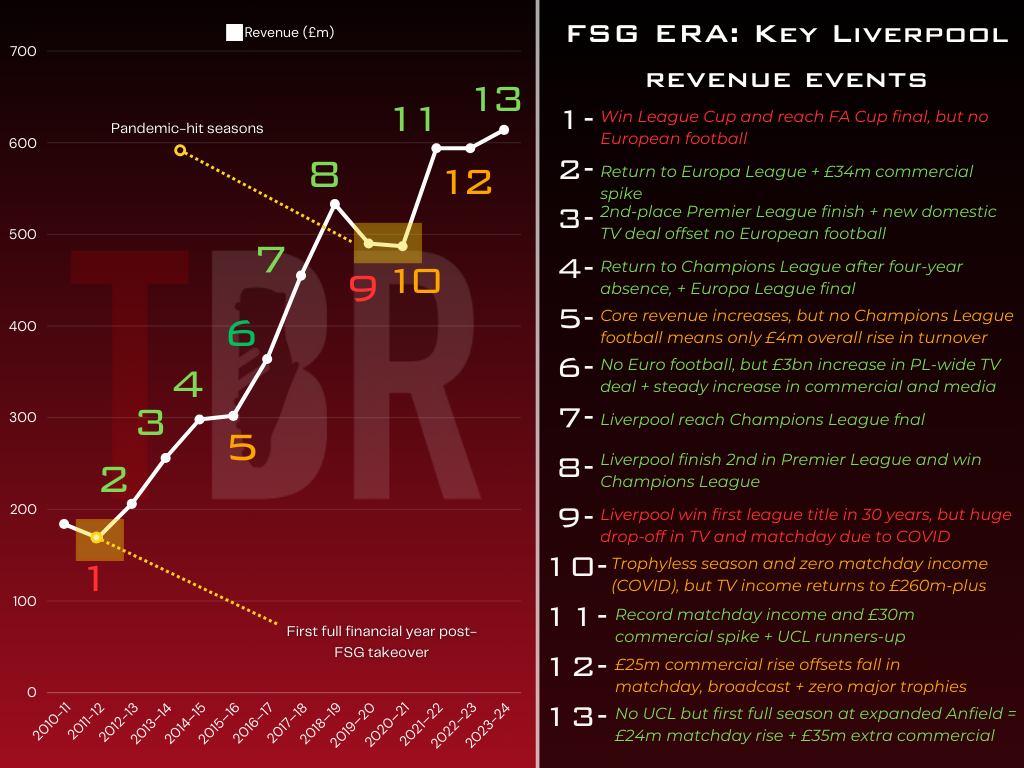

Liverpool’s revenue has soared under John Henry, Mike Gordon and Tom Werner’s 15-year reign, but football inflation was and is out of control.

The costs of competing in a ultra-fragment market with sovereign wealth, sundry tycoons, and private equity-backed clubs meant that increased turnover hasn’t equated to increased profits.

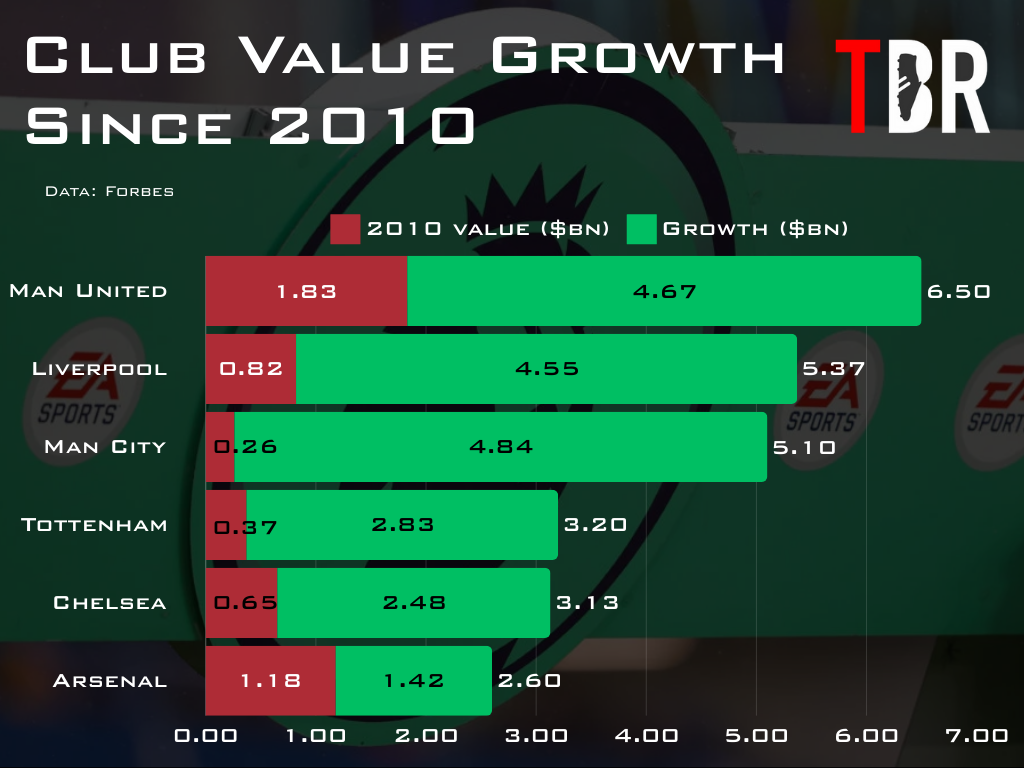

But despite the fact that no one is actually making any money, the value of Premier League clubs has been a runaway train in recent years.

Liverpool’s growth in compound terms has been the most impressive of the lot.

Photo by James Gill/Danehouse/Getty Images

In football finance, the ‘Greater Fool Theory’ sees clubs sold again and again for higher and higher prices, with new owners thinking they can be the ones to finally make money from the business in its own right.

One school of thought among experts is that there is no real value at the end of that chain – it’s a Ponzi scheme. Other pundits evangelise about tech, real estate and IP as being where the breakthrough lies.

But what is the grand plan at Liverpool and why, after FSG ultimately decided against selling the club, are the owners now all-in once again?

TBR Football spoke exclusively to Liverpool University football finance lecturer and industry insider Kieran Maguire for his analysis on the latest ownership revelation at Anfield.

Dynasty Equity’s Liverpool masterplan as firm join forces with FSG

In the end, after the market swung towards Manchester United and thee equity auction ultimately won by Sir Jim Ratcliffe, FSG opted for a minority sale to Dynasty Equity rather than a full takeover.

The exact size of that investment was under wraps until recently when Liverpool published their accounts for 2023-24 and confirmed that the deal was worth £127m, equating to about three per cent of the club.

Photo by Nick Taylor/Liverpool FC/Getty Images

That values the club at over £4bn, which tallies with Sportico’s recent appraisal of Liverpool as the fourth-most valuable club in football and 40th in the list of sports franchises worldwide.

The top-100 list is dominated by American franchises, reflecting the viability of the NFL, NBA, MLB and NHL’s business ecosystems, in stark contrast to the majority of European football leagues.

| Club | Value | 1-yr change | Owners | |

| 17 | Manchester United | $6.2B | +4% | Glazer family |

| 18 | Real Madrid | $6.06B | +16% | Club members |

| 35 | FC Barcelona | $5.28B | +7% | Club members |

| 40 | Liverpool | $5.11B | +8% | Fenway Sports Group |

| 46 | Bayern Munich | $4.8B | +8% | Club members |

| 51 | Manchester City | $4.75B | +7% | Mansour bin Zayed Al Nahyan |

| 61 | Paris Saint-Germain | $4.05B | +19% | Qatar Sports Investment |

| 65 | Arsenal | $3.91B | +9% | Stan Kroenke |

| 74 | Tottenham Hotspur | $3.49B | +9% | Joe Lewis family trust, Daniel Levy |

| 75 | Chelsea | $3.47B | ±0% | Todd Boehley, Clearlake Capital |

Dynasty Equity want piece of FSG’s asset growth, says Kieran Maguire

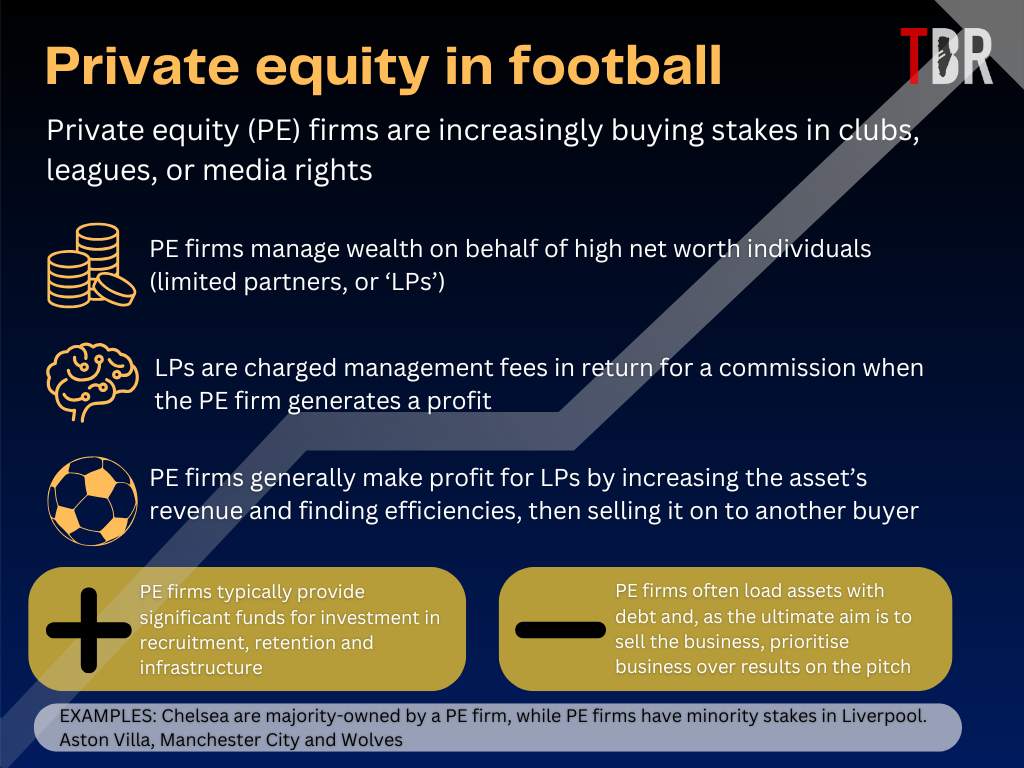

At three per cent, Dynasty Equity – a sports-specific firm with only a handful of known investments – will have zero operational control at Anfield.

Typically, private equity firms take the opposite approach. They buy companies outright, assume full operational control, optimise costs and revenues, and eventually flip the business for a profit.

Credit: Adam Williams / GRV Media / TBR Football

So what is in it for Dynasty Equity and their limited partners?

“Put it this way – they don’t want to be standing in the Kop singing You’ll Never Walk Alone,” Kieran Maguire, host of the Price of Football podcast, tells TBR Football.

“It’s a non-football investment and they are looking for a financial return. They will see the capital appreciation that has arisen at Anfield under FSG and want a portion of that.

“If that continues over the course of the next five or six years, they are in line for a massive value increase. It’s classic private equity to a certain extent.

“They aren’t going to get involved in business decisions. They must hold FSG’s approach in high regard – and rightly so. Liverpool punch above their weigh in terms of total player spend – net transfer outlay plus wages.”

American market and UEFA’s controversial new media deal are key

So, it’s likely to be a capital appreciation model, according to Maguire.

But the pool of investors with both the capacity and inclination to buy a three per cent stake at a markup on the £127m Dynasty Equity paid is vanishingly small as it stands.

| Season | |

| League Cup | 2023-24, 2021-22, 2011-12 |

| FA Cup | 2021-22, 2011-12 |

| Champions League | 2021-22 (runners-up), 2018-19, 2017-18 (runners-up) |

| Premier League | 2021-22 (runners-up), 2019-20, 2018-19 (runners-up), 2013-14 (runners-up) |

| Club World Cup | 2019-10 |

| Europa League | 2015-16 (runners-up) |

Here, we run into the same value problem. At some point in the chain, profit needs to be created, or else club valuations will be a bubble. When the price of an asset surpasses its inherent value, bubbles burst.

But where is this mystery value for Dynasty? “They’ll be looking for an exit route at a profit,” says Maguire.

“There is still a bullet of growth from American investors in terms of how the Metaverse and other tech can be beneficial to clubs.

“If that scales as some of them genuinely believe it can, you can see revenues rising far faster than costs, and on the back of that, you have a good sale price.

“They’re looking for a global product. The deal that Relevant Sports and UEFA have is further indication of a softening with their stance on taking matches to the US and other markets where the highest payers are.

“That train has already left the station as far as that is concerned.”

In February, UEFA revealed that they had entered into exclusive negotiations with the Relevant Sports agency for its exclusive commercial and media rights.

On face value, it’s an industry story whose interest doesn’t go outside the sports business bubble. However, this development could in fact have a profound impact on fans and the future of the sport.

For 30 years, UEFA have partnered with Team Marketing, who finessed their commercial and media rights and have been credited with the development of the Champions League brand.

“I’m determined one day to have a Premier League game be played in New York City.”

Tom Werner, FSG Chairman

The move to Relevant is seen as an endorsement of that company’s desires to take Champions League matches to the United States for the very first time.

Incidentally, FSG chairman Tom Werner has already revealed that this is a long-standing ambition of his.

“I’m determined one day to have a Premier League game be played in New York City,” he said last year.

“I even have the sort of crazy idea that there would be a day where we play one game in Tokyo, one game a few hours later in Los Angeles, one game a few hours later in Rio, one game a few hours later in Riyadh and make it sort of a day where football, where the Premier League, is celebrated.”

Although, that may have been a slip of the tongue, as Werner’s peers in the FSG boardroom have distanced themselves from his comments.

- READ MORE: David Ornstein says Liverpool will only make a move for Newcastle’s Alexander Isak on one condition

Have FSG held secret new talks with European Super League chiefs?

The Super League project was the nadir of FSG’s time at Liverpool, both for the fans and the owners – for wildly different reasons.

Publicly, FSG were full of rhetoric about soul-searching, increased fan engagement, and fawning praise for supporters who had brought the breakaway crashing down. Privately, it was a different story.

Now, the European Super League is back. This time, it calls itself the ‘Unify League’ and is more similar in form to the expanded Champions League.

The proposal has been put forward by A22 Sports Management, a firm funded by Real Madrid and Barcelona with the single aim of resurrecting the competition.

Bernd Reichart, CEO of A22, recently claimed that he has spoke to 10 English clubs about joining up, who he says are all very keen.

He did not mention Liverpool by name, although reports in Spain have suggested that the Reds are among the teams interested, in contrast to what the club themselves have said.

However, the UK government will soon introduce a new independent football regulator which is expected to have the power to block breakaway leagues, so what is the goal here for Liverpool?

Some analysis have suggested that the mere threat of a new Super League could force UEFA to agree concessions with elite clubs like Liverpool, so it could be that the new proposal is a negotiating tactic.

Indeed, this is the reason that Liverpool, who face Paris Saint-Germain in the second leg of their Champions League round-of-16 tie tonight, lobbied for the format in Europe’s premier club competition.

Champions League prize money available to Liverpool

- Winner: €25m (£21m)

- Runner-up: €18.5m (£15.6m)

- Semi-finalists: €15m (£12.6m)

- Quarter-finalists: €12.5m (£10.5m)

- Round of 16: €11m (£9.3m)

- Reaching knockout round play-off: €1m (£842,669)

- League-phase wins: €2.1m (£1.8m)

- League-phase draws: €700,000 (£589,868)

The expanded Champions League has already yielded close to £100m for Liverpool, who topped the 36-team group stage and whose takings could reach £150m if they go all the way this season.

It isn’t the revenue that a revolutionary European Super League would have generated, but it’s welcome all the same for FSG and, now, Dynasty Equity.