Football is financially dysfunctional – for most clubs, the numbers simply don’t stack up. But Liverpool and Tottenham are outliers, with FSG and Daniel Levy priding sustainability above all else.

ENIC and Fenway Sports Group are the most conservative owners in the so-called ‘Big Six’. In the commercial department and the transfer market, they prioritise value and eschew risk

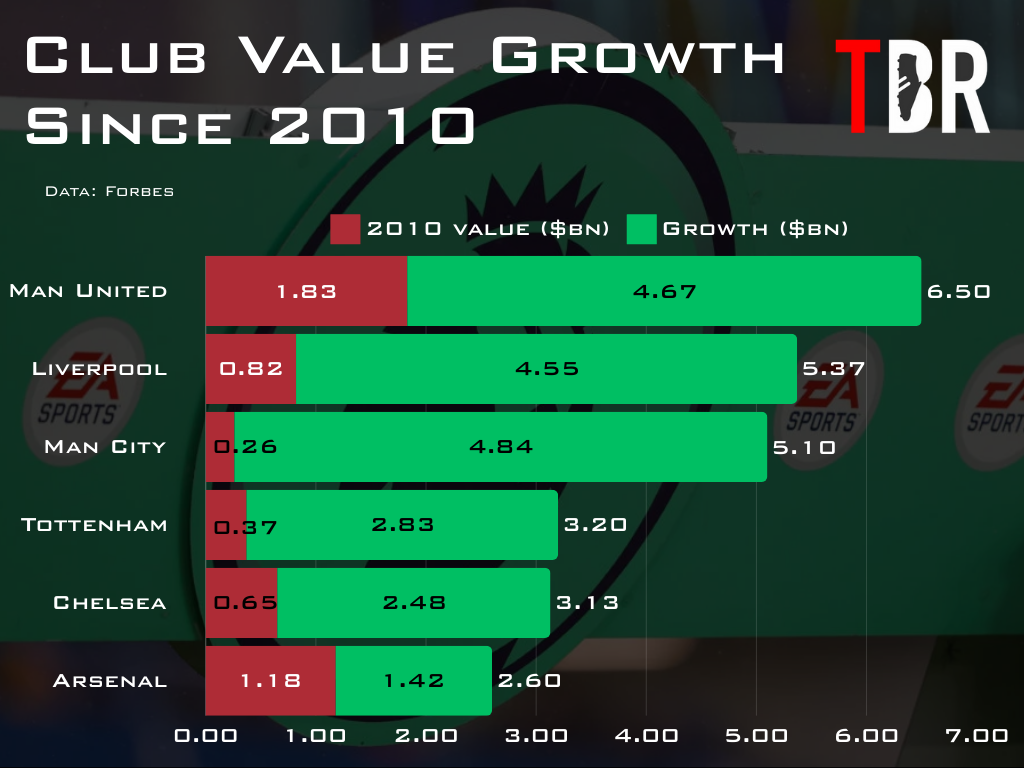

Daniel Levy, John Henry and their various deputies in their respective clubs’ ownership regimes have had the best return on investment of any Premier League side in recent years as a result.

Photo by Nick Taylor/Liverpool FC/Getty Images

Neither ENIC nor FSG take money out of Spurs or Liverpool besides relatively modest management fees, but soaring commercial, matchday and media income has seen both clubs’ enterprise values explode.

When they one day sell up, as is the plan under their capital appreciation models, it will be at an astonishing markup on the paltry £90m and £300m they paid in 2001 and 2010 respectively.

| Major honours since Tottenham last won a trophy | |

| Man City | Premier League (8), FA Cup (2), League Cup (6), UEFA Champions League (1), Super Cup (1), Club World Cup (1) |

| Man United | Premier League (4), FA Cup (2), League Cup (4), UEFA Champions League (1), Club World Cup (1), UEFA Europa League (1) |

| Chelsea | Premier League (3), FA Cup (4), League Cup (1), UEFA Champions League (2), Europa League (2), Super Cup (1), Club World Cup (1) |

| Liverpool | Premier League (1), FA Cup (1), League Cup (3), UEFA Champions League (1), Super Cup (1), Club World Cup (1) |

| Arsenal | FA Cup (4) |

| Leicester City | Premier League (1), FA Cup (1) |

| Wigan | FA Cup (1) |

| Portsmouth | FA Cup (1) |

| Birmingham | League Cup (1) |

| Swansea | League Cup (1) |

| West Ham | Conference League (1) |

On the pitch, of course, this shared approach has yielded wildly different results.

Liverpool missed out on their first silverware of the season with defeat to Newcastle United in the League Cup final on Sunday but will be Premier League for the second time under FSG in a matter of weeks.

Tottenham lost 2-0 to Fulham earlier in the day and are 14th in the league table. Since they last won a trophy in 2008, FSG-owned Liverpool have won eight.

| Position | Team | Played MP |

Won W |

Drawn D |

Lost L |

For GF |

Against GA |

Diff GD |

Points Pts |

| 29 | 21 | 7 | 1 | 69 | 27 | 42 | 70 | ||

| 2 | 29 | 16 | 10 | 3 | 53 | 24 | 29 | 58 | |

| 3 | 29 | 16 | 6 | 7 | 49 | 35 | 14 | 54 | |

| 4 | 29 | 14 | 7 | 8 | 53 | 37 | 16 | 49 | |

| 5 | 29 | 14 | 6 | 9 | 55 | 40 | 15 | 48 | |

| 6 | 28 | 14 | 5 | 9 | 47 | 38 | 9 | 47 | |

| 7 | 29 | 12 | 11 | 6 | 48 | 42 | 6 | 47 | |

| 8 | 29 | 12 | 9 | 8 | 43 | 38 | 5 | 45 | |

| 9 | 29 | 12 | 9 | 8 | 41 | 45 | -4 | 45 | |

| 10 | 29 | 12 | 8 | 9 | 48 | 36 | 12 | 44 | |

| 11 | 29 | 12 | 5 | 12 | 50 | 45 | 5 | 41 | |

| 12 | 28 | 10 | 9 | 9 | 36 | 33 | 3 | 39 | |

| 13 | 29 | 10 | 7 | 12 | 37 | 40 | -3 | 37 | |

| 14 | 29 | 10 | 4 | 15 | 55 | 43 | 12 | 34 |

Spurs’ malaise is of course taking place against the backdrop of Daniel Levy’s attempts to secure fresh investment, either in the form of a full or partial takeover.

This is a process FSG have already undergone at Anfield, selling a three per cent stake in the club to Dynasty Equity in September 2023 for £127m.

That deal valued Liverpool at over £4bn, which is a slight uptick on Levy’s £3.75bn appraisal of Tottenham.

Photo by James Gill/Danehouse/Getty Images

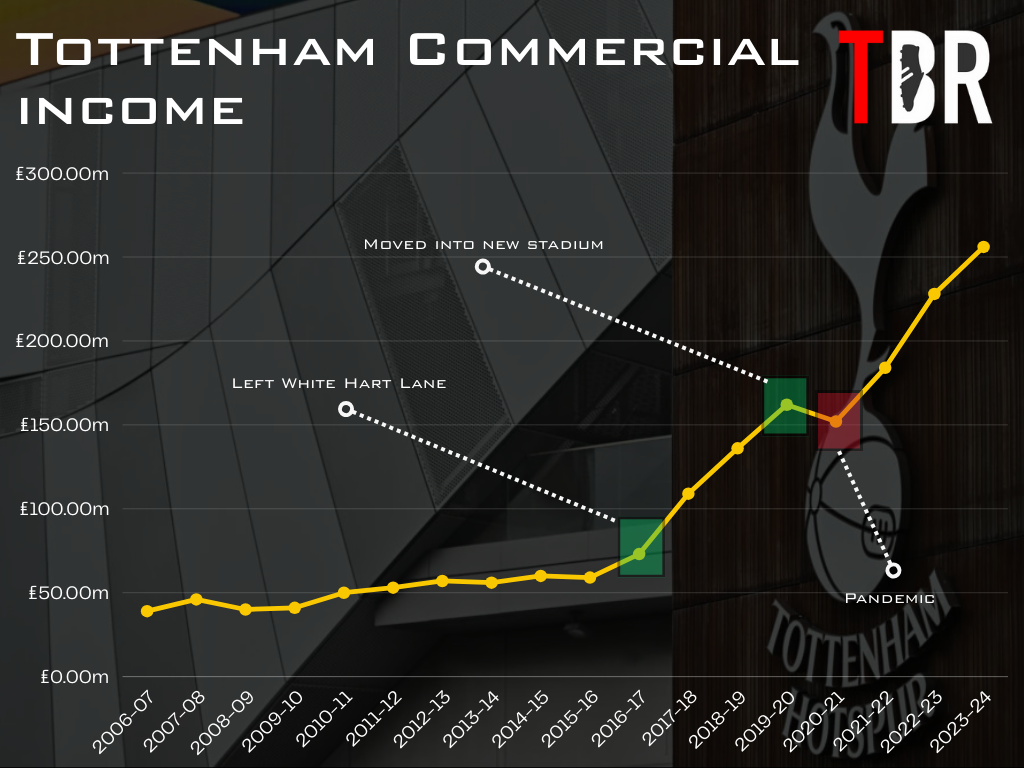

How do FSG and ENIC justify those valuations? Their clubs’ ineffable ‘brands’ and their ability to sell products, media deals and sponsorships is significant, but so too is old-fashioned bricks-and-mortar.

Tottenham have what is considered the world’s best football stadium, though Manchester United could soon snatch that crown.

Matchday income is worth £100m-plus even in a bad year and the various non-football events they host year-round have helped Spurs triple their commercial income since the move from White Hart Lane.

Photo by Vince Mignott/MB Media/Getty Images

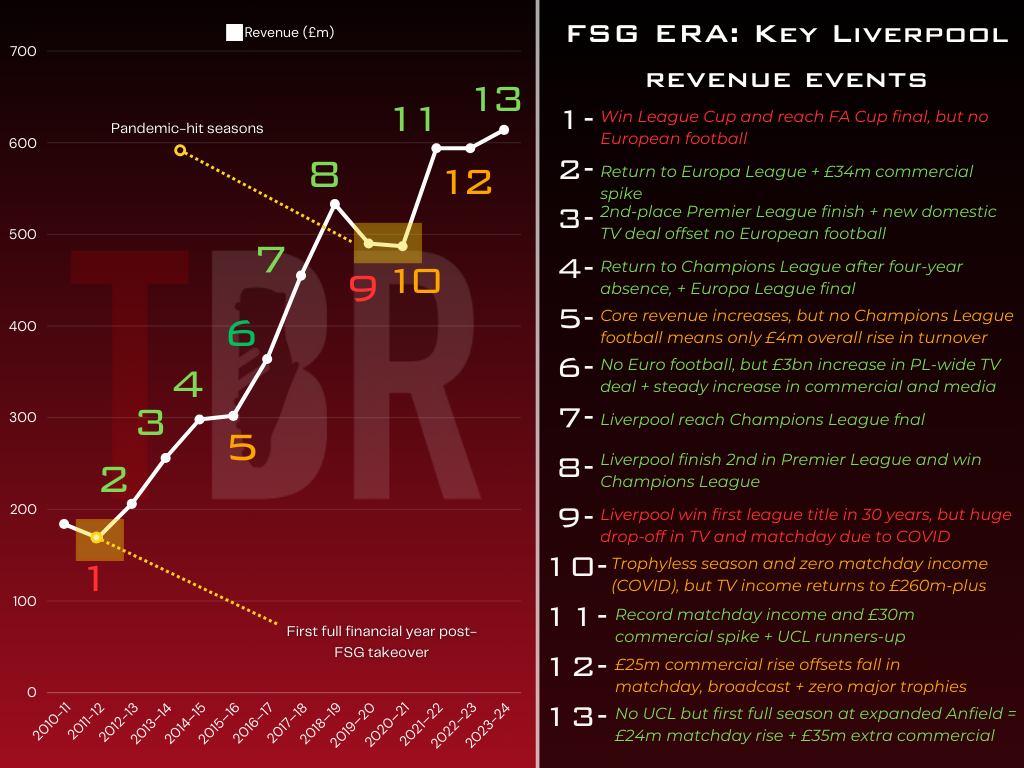

Liverpool meanwhile have gradually increased capacity at Anfield, from around 40,000 when FSG took over from Tom Hicks and George Gillett to 61,000 in 2024-25.

Like Spurs, cash through the turnstiles and commercial income has soared in correlation as the stadium has expanded.

Coupled with the Premier League’s extraordinary TV deal and a discipline in terms of costs that has been in short supply at most clubs, these developments have sent enterprise value stratospheric in L4 and N17.

Credit: Adam Williams / GRV Media

But there has been full-throated resistance to the rising cost of supporting their teams from fans at times, though Spurs and Liverpool are hardly unique in this department.

Now, it appears that the pushback has got to both boardrooms.

Tottenham respond to Liverpool’s ticket price freeze

There is a herding mentality in Premier League ownership regimes, with the ‘Big Six’ in particular driving the agenda at many shareholder meetings.

That was seen in microcosm when Liverpool announced in mid-February that they were freezing season ticket and general admission prices for 2025-26.

Fans have staged several protests against rising ticket prices, while groups like Spirit of Shankly and the Stop Exploiting Loyalty campaign have repeatedly raised the issue in official channels.

Liverpool earned almost £114m in matchday income last season, while Spurs banked roughly £106m.

The mood music among football finance and business professionals canvassed by TBR Football was that Liverpool’s decision to pause rising prices would force other clubs to do the same.

And sure enough, West Ham, whose fans have also done exceptional work in their protests against rising prices and the phasing out of concessionary rates, followed suit a fortnight later.

Now, Spurs, who have also faced major protests relating to concessions pricing and the general expense of the matchday experience at the Tottenham Hotspur Stadium, have also frozen their prices.

In truth, it would have been the hardest of hard sells to justify an increase in prices given the season they are having under Ange Postecoglou.

But the club’s decision to back down over ticket prices is testament to the collective action of supporters and the collaborative approach to the issue between rival fanbases.

Increasingly, elite clubs are becoming less reliant on general admission ticket sales anyway, with corporate hospitality now the biggest ticket in town.

There is less resistance to higher prices in that market. Some clubs are now charging tens of thousands of pounds for season tickets in the most exclusive areas of their stadiums.

Food and drinks is a far bigger revenue driver than it has been historically too, with Tottenham able to make almost £1m per match from refreshments alone.

Liverpool’s multi-club plans: Who will FSG take over next?

In other news, FSG have reportedly whittled down their shortlist of potential takeover targets to four.

Having re-appointed Michael Edwards to oversee a multi-club empire last summer, Liverpool are big admirers of the type of model employed by Manchester City and Red Bull.

Credit: Adam Williams/GRV Media/TBR Football

But after a deal to acquire historic French side Bordeaux fell through last summer, there have been few specific updates on the progress of the multi-club project.

“If there is one club that does its homework before it makes a decision, it’s Liverpool,” says Kieran Maguire, a lecturer in football finance at Liverpool University, speaking exclusively to TBR Football.

“They will be looking at a variety of clubs if they decide to go through with this model.

“Equally, if Liverpool have found out that a multi-sport model is perhaps just as lucrative, they have got so much skill and knowledge across a variety of sporting entities.

CREDIT: Adam Williams / GRV Media

“They are able to make practically all of them successful – both on and off the pitch. It could be that they just want to focus on Liverpool as their main football investment.

“But they will have considered other options in terms of the European market and the benefits that brings as well.”