Liverpool and Man City’s on-pitch rivalry has defined an era in the Premier League which is now fading from view – but it’s the internecine conflict in the offices of the ‘Big Six’ that may shape the next one.

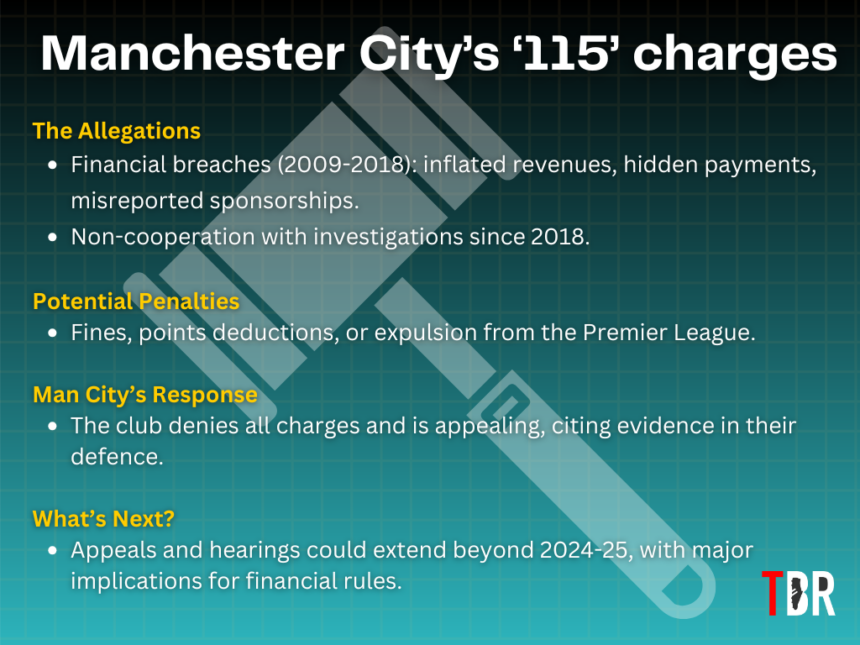

It has been over two years since Manchester City were charged with over 115 counts of financial breaches, but the politicking, led by Liverpool and a handful of their peers, has been going on far, far longer.

We now appear to be approaching, if not the beginning of the end, at least the end of the beginning. The Premier League’s case against Man City has concluded, with the judges now considering their verdict.

CREDIT: Adam Williams / GRV Media

Liverpool have reserved the right to seek compensation if City are found guilty, though the consensus in football finance and commercial arbitration circles is that it’s unlikely be a binary win-lose result.

When the outcome is announced, both sides will be entitled to launch an appeal. That means we may still be over a year away from this saga’s final seismic crescendo.

The seeds were planted what seems like a lifetime time ago. Both Liverpool and City have had debutants this season who weren’t born when the Abu Dhabi-backed takeover was confirmed in September 2008.

It was Tom Hicks and George Gillett, not Fenway Sports Group (FSG), who were in charge of Liverpool at the time. Indeed, before the City deal, Sheikh Mansour had tried to buy the Reds.

By the time FSG’s £300m takeover of Liverpool got over the line in 2010, the debate about what was increasingly being characterised as the insidious role of nation states in football was well underway.

Liverpool, Arsenal and Manchester United were – and are – leading the charge, arguing that the wealth and political influence of states with bottomless wells of resources would end football as we know it.

There is more than of irony about that stance given that United, Liverpool and Arsenal have shared nearly 70 per cent of post-war league titles in English football, but it’s hard to argue they didn’t have a point.

Clubs with more than five English league titles

| Club | Titles won | Year |

| Manchester United | 20 | 1908, 1911, 1952, 1956, 1957, 1965, 1967, 1993, 1994, 1996, 1997, 1999, 2000, 2001, 2003, 2007, 2008, 2011, 2013 |

| Liverpool | 19 | 1901, 1922, 1923, 1947, 1964, 1966, 1973, 1976, 1977, 1978, 1979, 1982, 1988, 1989, 1990, 2001, 2009, 2020 |

| Arsenal | 13 | 1991, 1992, 1993, 2002, 2004, 2005, 2006, 2007, 2008, 2015, 2017, 2018, 2021 |

| Manchester City | 10 | 1937, 1968, 2012, 2014, 2018, 2019, , 2021, 2022, 2023, 2024 |

| Everton | 9 | 1891, 1928, 1932, 1939, 1963, 1970, 1985, 1995, 2000 |

| Aston Villa | 7 | 1894, 1896, 1897, 1900, 1910, 1981, 1990 |

| Chelsea | 6 | 1955, 2005, 2006, 2010, 2015, 2017 |

| Sunderland | 6 | 1892, 1902, 1913, 1936, 1973, 2015 |

City – who weren’t subject to Profit and Sustainability Rules (PSR), formerly ‘financial fair play or FFP’ – for the first four seasons of their new era have raised the bar in so many ways.

The vision, ambition and resources to launch the planet’s first serious multi-club network, build the world’s best sports complex, and short-circuit the transfer ecosystem are the reserves of states alone.

Whatever your position, what they have achieved both on and off the field of play is awe-inspiring.

Credit: Adam Williams/GRV Media/TBR Football

The accusation from rivals, however, and one which Man City refute in the strongest possible terms, is that they have cheated the system in doing so.

The natural riposte is that it was a system set up with the tacit aim of preventing Man City – and now a slew of private equity-backed, uber-ambitious clubs – from climbing football’s highest peaks.

Whichever side of the modern game’s iron curtain you sit on, the lawfare and conspiratorial rhetoric on both sides of the isle that have gripped the Premier League as a result are not what football should be.

And while grey-faced lawyers continue to coin it in off the back of the whole sorry story, both Liverpool and City have to carry on as normal, pretending like the sword of Damocles isn’t swing above their heads.

Part of that is routine preparations for 2025-26, which will likely be a season of transition for both Arne Slot and Pep Guardiola for different reasons.

But, as Liverpool University football finance lecturer and industry insider Kieran Maguire has explained in exclusive conversation with TBR Football, even transfer business doesn’t exist in a ‘115 charges’ vacuum.

Manchester City’s financial charges case will influence Liverpool’s summer

For Liverpool, the three greats of the Jurgen Klopp era – Mohamed Salah, Virgil van Dijk and Trent Alexander-Arnold – could be on their way after the Premier League title parade this summer.

| Position | Team | Played MP |

Won W |

Drawn D |

Lost L |

For GF |

Against GA |

Diff GD |

Points Pts |

| 1 | 29 | 21 | 7 | 1 | 69 | 27 | 42 | 70 | |

| 2 | 29 | 16 | 10 | 3 | 53 | 24 | 29 | 58 | |

| 3 | 29 | 16 | 6 | 7 | 49 | 35 | 14 | 54 | |

| 4 | 29 | 14 | 7 | 8 | 53 | 37 | 16 | 49 | |

| 5 | 29 | 14 | 6 | 9 | 55 | 40 | 15 | 48 |

Alexander-Arnold is Real Madrid-bound. That much, we know for sure. And while there’s no way of spinning the loss of one of the game’s most unique players as a positive, it will free up a huge wage.

If Salah and Van Dijk leave too, that will see Liverpool’s wage bill cut by the best part of £1m per week when bonuses and image rights are taken into account.

FSG almost never deviate from a wages-to-turnover ratio of around 60 per cent, which suggests all the cash will be reinvested.

Photo by Michael Regan/Getty Images

The cost of adequately replacing the trio, however, would obviously far, far outweigh the money saved.

So how much will FSG, whose offices five time zones away in Boston will insulate them from the fury of fans in L4 should that situation come to pass, push the boat out in the would-be summer rebuild?

And, zooming out on the graph, what part will the uncertainty around City and the volatility in football’s political nexus impact their approach?

“There is a series of moving parts here,” Maguire explains.

“FSG’s primary ambition is to get Champions League football. That’s where the real value lies for the ownership.

“As well as the potential departure of two of the three, there will be an awful lot of focus on what is happening with the Manchester City verdict – five into four is a lot easier than six into four.

“They will be monitoring that situation very closely.”

Liverpool’s summer transfer budget as Mohamed Salah and Virgil van Dijk’s futures hang in balance

In September 2023, FSG very nearly decided to sell Liverpool. That was at least partly because of the cash and man hours that they need to invest to keep pace with the likes of Man City.

It’s not like their other flagship investments in the United States, where the financial mechanics of US franchise sport means they are all but guaranteed a return every single year.

In the end, they opted to realise some of their initial £300m investment and spending on the expansion of Anfield by selling a three per cent stake to Dynasty Equity, a sports-specific private equity firm, for £127m.

Photo by Nick Taylor/Liverpool FC/Getty Images

The grand vision, however, is to one day flip Liverpool for a huge profit. How soon? No one can say, but could their level of ambition this summer be a tell?

After all, you don’t invest in an expensive new engine if you’re about to sell the car.

“They are a cautious ownership regime and they have traditionally bought smart rather than bought big,” says Maguire.

“They have certainly invested in wages. The average wage at Anfield is £179,000 per week, so they have one of the biggest budgets there.

“If, say, Van Dijk and Alexander-Arnold leave, that will free up a substantial amount in terms of the wage element. They will not be scared of spending big.

“Their spending over the course of the last five seasons has been pretty modest by Premier League standards, so they have an awful lot of scope to spend more if they choose to do so.

“From a PSR point of view, they are in a very strong position. It’s a case of making sure you make the right decisions.

“Michael Edwards knows his own mind. The wages-to-turnover ratio will drop quite significantly if some players leave, so I don’t see it as a problem.”

- READ MORE: FSG reveal how Liverpool can make way more than £102m from Anfield as expansion stance emerges

Who is the heir to FSG’s throne at Anfield?

If the plan is for FSG to sell, who to?

Liverpool value themselves at around £4bn but, even though they are one of the best-run clubs in world football, have only just about broken even financially in the FSG era.

On top of that, Fenway have injected several hundred million pounds into the club to revamp Anfield out of their own pocket, not the club kitty.

So, the Boston-headquartered ownership are in the red at Liverpool after 15 years and, when the club have made profits, they have not drawn dividends from them.

If you had a spare £4bn down the back of the sofa, is that the kind of business profile you’d invest in?

On face value, it looks like a money pit. However, FSG think they know better. And given that the big brains in the world of high finance agree with them on club valuations, who is to doubt them?

But where is the mystery value?

Well, most experts TBR speaks to tend to gesture in the direction of the overseas fanbase and better monetising them, perhaps through immersive technology or another media innovation.

But that demands serious infrastructure investment – and none of Europe’s biggest and best clubs, including Liverpool, are anywhere near achieving this level of engagement.

Todd Boehly, co-owner of Chelsea, said something interesting on the topic in a recent media appearance: “When you have the IP that we have, you’re only limited by your creativity.”

Intellectual property – in layman’s terms, the club’s brand, its history and corresponding power to sell products and services – is what football club’s trade off.

But we’re getting into increasingly esoteric territory here, and we’re talking 20-years-plus timescales to grow revenues off the back of IP to the point where these club valuations are justifiable.

Maybe, just maybe, these valuations are a speculative bubble.

In any case, if FSG’s is a capital appreciation approach, not one geared towards skimming off the top of profits, there is a tiny pool of investors for whom a £4bn-plus outlay is even possible.

Sovereign wealth funds could be the dream ticket for FSG, but there are only so many of those who aren’t, as is the case with Man City, Newcastle and PSG’s ownerships, already all-in on one club.

Private equity too is increasingly interested in football as an asset class, but they are ultimately beholden to their investors, who usually want a return in seven or eight years maximum.

There might be some flex on that timescale for a statement investment in a club like Liverpool, but it’s a hard sell.