Fenway Sports Group, or FSG, are now elder statesmen in the Premier League having pitched up at Liverpool following a £300m takeover from Tom Hicks and George Gillett 15 years ago.

In time, John Henry, Tom Werner and Mike Gordon – who occupy FSG’s throne room in Boston – will probably look back at that deal as the best of their careers.

Fenway have invested almost no money in Liverpool besides funds for the redevelopment of Anfield, most of which was in the form of interest-free loans they will probably one day recoup.

Unlike most in the Premier League and indeed the wider football finance ecosystem, FSG don’t like the benefactor model. In other words, Liverpool only spend what they earn.

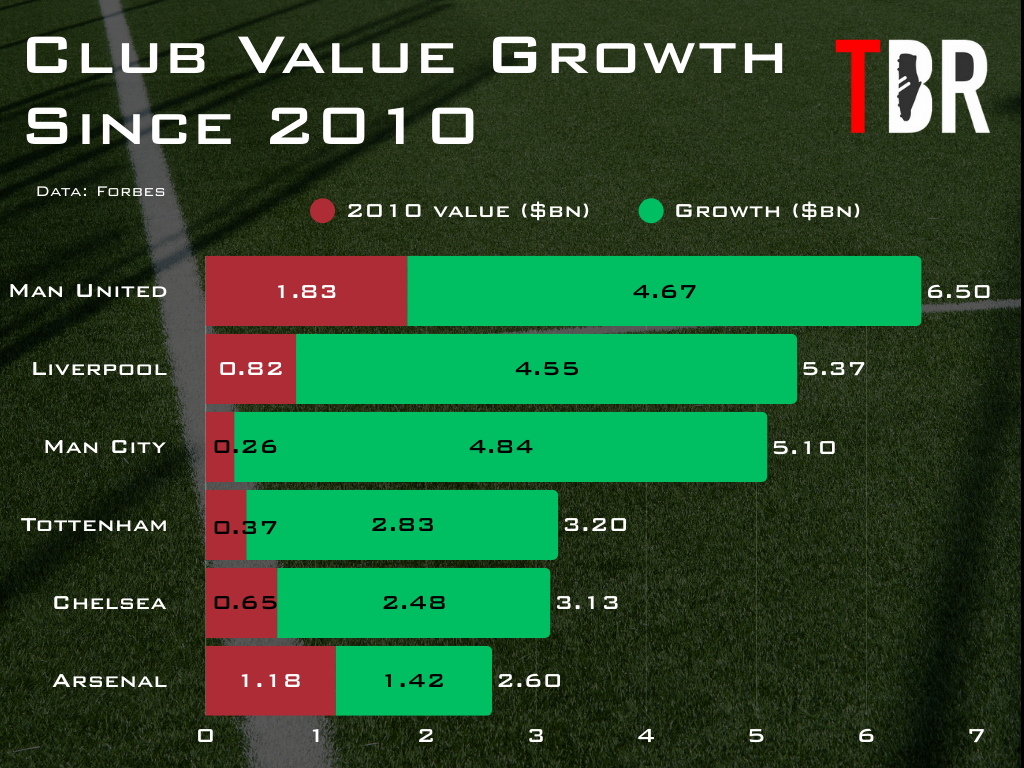

In spite of that, the club has appreciated in value many times over since the takeover in 2010. Liverpool are now worth well north of £4bn, according to most reliable analysis.

Of course, countless man hours and resources at FSG HQ have been invested over the same period but those expenses are dwarfed by the bonanza the owners are in for when they cash in on the club.

Credit: Adam Williams/TBR Football/GRV Media

Liverpool fans have their reservations about the American, hyper-capitalist regime – and with good reasons that run deeper than the contract stalemates with Mohamed Salah and Virgil van Dijk.

The European Super League project in 2021 proved that they aren’t as deferential to supporters as their misty-eyed rhetoric about the Anfield atmosphere and the legacy of Shankly, Fagan and Paisley implies.

Indeed, in April of that year, it spoke volumes that the family of Bill Shankly asked for the statue of the great man at Anfield to be taken down in light of FSG’s breakaway treachery.

Photo by Nick Taylor/Liverpool FC/Getty Images

And while the owners deserve credit for greater fan engagement in the intervening years and the freeze on general admission ticket prices for next season, those wounds will take time to heal in full.

That said, what FSG have achieved in 15 years on a self-sufficient model is quite extraordinary. It will be studied in sports management MBAs for years to come.

Despite a slight drift in the closing throes of the season, Liverpool are on the precipice of a second Premier League title, which will be the ninth major trophy of the FSG era.

| Major Trophy | Season |

| League Cup | 2023-24, 2021-22, 2011-12 |

| FA Cup | 2021-22, 2011-12 |

| Champions League | 2021-22 (runners-up), 2018-19, 2017-18 (runners-up) |

| Premier League | 2021-22 (runners-up), 2019-20, 2018-19 (runners-up), 2013-14 (runners-up) |

| Club World Cup | 2019-10 |

| Europa League | 2015-16 (runners-up) |

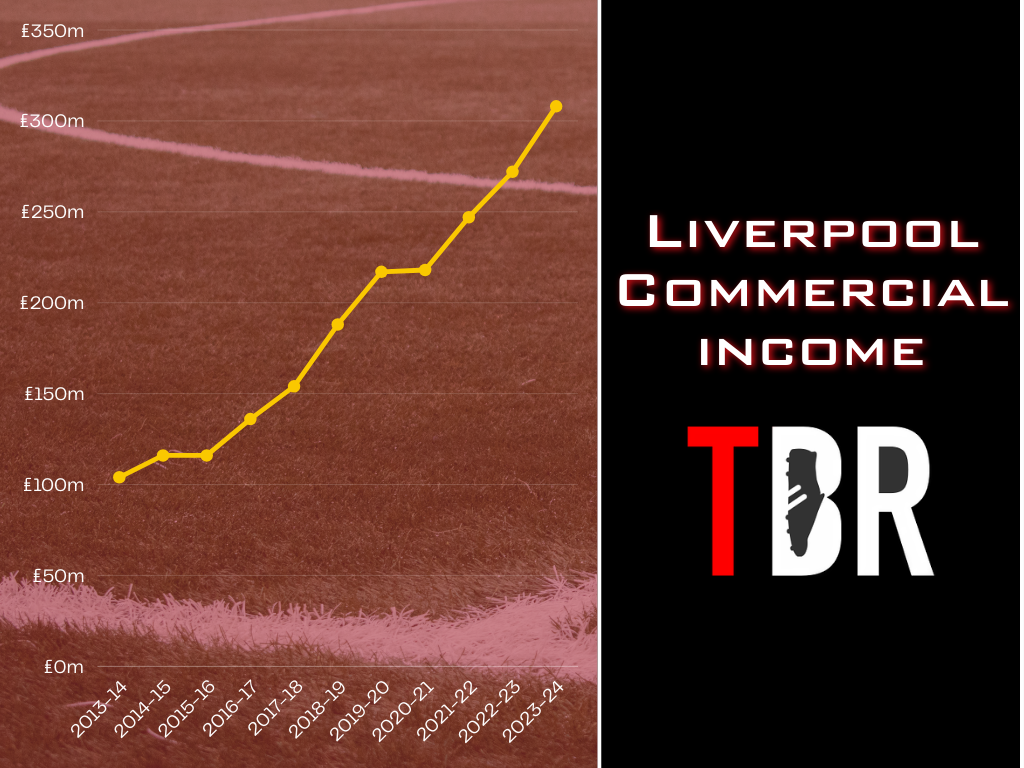

Their work off the pitch – which, remember, under the self-funding model is what funds Arne Slot and Richard Hughes’ transfer and wage budget – has been equally impressive.

Commercial income has trebled in the last 10 years, while its conceivable that matchday income may have achieved the same feat within the next couple of seasons.

This season, a revamped commercial department headed up by Ben Latty and his deputy Kate Theobald have struck lucrative new contracts with Lucozade and Japan Airlines.

Credit: Adam Williams/TBR Football/GRV Media

Most significantly, Liverpool’s kit deal with Adidas, which commences in 2025-26, is expected to generate between £60m and £90m annually and run for over five years.

And with the resources and know-how at FSG’s disposal, the train shows no signs of slowing down.

FSG co-owners RedBird hire new partner as Liverpool step-up financial campaign

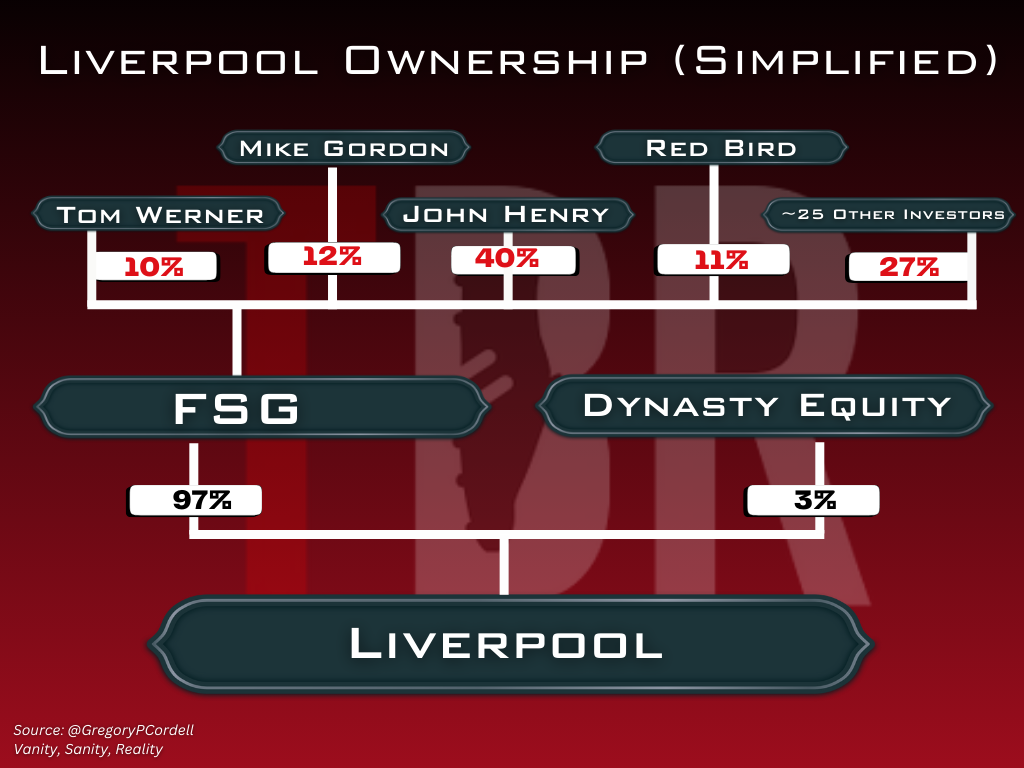

Liverpool’s ownership structure is relatively uncomplicated, with FSG the sole owners aside from a three per cent stake owned by the sports-specific private equity firm Dynasty Equity.

Fenway Sports Group’s corporate web, on the other hands, is more nebulous.

John Henry is the biggest single shareholder, controlling 40 per cent. Mike Gordon and Tom Werner own 10-12 per cent stakes respectively, while an estimated 20-25 investors control around 27 per cent.

Credit: Adam Williams/TBR Football/GRV Media

The remaining 10 or 11 per cent belongs to RedBird Capital, an investment management firm whose figurehead is Gerry Cardinale, whose specialises in monetising IP.

This is likely at least one of the reasons Cardinale has invested in FSG. In layman’s terms, IP is the license to sell products and experiences using Liverpool’s badge, history and trademarks.

Liverpool’s commercial income was £308m at the last count, which was only bettered by Manchester City at the last count. Their IP is big, big business for FSG and their investors.

Credit: Adam Williams/GRV Media/TBR Football

RedBird – who also own AC Milan and Tolouse – are passive investors in Liverpool, so their ties with other European teams are not deemed deep enough to violate UEFA’s conflict of interest regulations.

However, their commercial acumen will certainly be leveraged by FSG. And with a new partner in the business, Liverpool will likely benefit too.

Per Bloomberg, RedBird have hired Massimo Calvelli as their new operating partner.

The commercial department will be Calvelli’s remit, with a specific focus on monetising RedBird’s assets in sport, media and entertainment.

Calvelli has previously worked at Nike and, in his most recent role, as CEO of the ATP, the body that governs men’s tennis.

Liverpool appoint data mastermind with multi-club takeover imminent

Elsewhere on planet FSG, Laurie Shaw is leaving Manchester City’s City Football Group to take a new position as head of their data department, with duties across Liverpool and FSG’s other sports teams.

Shaw is a former Harvard University researcher and lecturer and a specialist in data science, physics and artificial intelligence. He has previously acted as a policy adviser for the UK government.

His employment at City Football Group lasted four-and-a-half years and he was responsible for data science across its network of 12 clubs.

Credit: Adam Williams/GRV Media/TBR Football

His experience will come in useful given that Liverpool are launching their own multi-club network, which is one of the reasons that Michael Edwards returned to FSG last summer.

In July, FSG were in talks to take over Bordeaux, one of French football’s fallen giants. Having pulled out of those negotiations, Spanish second-tier side Malaga are now in their crosshairs.

Liverpool’s owners have competition there though – Qatar Sports Investments, who own Paris Saint-Germain and Portuguese outfit Braga, are said to be in the advanced stages of thrashing out a deal.

All-Premier League affair: Liverpool, Chelsea and Man City investors linked in £500m deal

One more interesting development in the Premier League’s corporate melting pot, again involving RedBird.

RedBird IMI, a joint venture between the private equity firm and International Media Investments, are in talks to sell The Telegraph newspaper to Todd Boehly, the owner of Chelsea.

International Media Investments meanwhile are financed by the Abu Dhabi government, who are the de-facto owners of Manchester City.

The Premier League themselves are said to have cleared the deal amid concern in some quarters that, as a media outlet that covers the competition, there could be a conflict of interest between Chelsea and The Telegraph.

So, the owners of Man City and owners once removed of Liverpool are in talks to sell an outlet with extensive Premier League coverage to the co-owner of Chelsea, in a deal approved by the league itself.

If ever there was a transaction to illustrate the Premier League’s sprawling geopolitical and financial presence, this is it.