Stan Kroenke understands real estate better than probably anyone in football but the Arsenal owner has not yet had the chance to stamp his property brand on the Emirates Stadium.

Opened in 2006, the Emirates has had only minor work done since Stan Kroenke first invested in the Gunners in 2007, nothing like the expansion seen at Liverpool and Manchester City in that time.

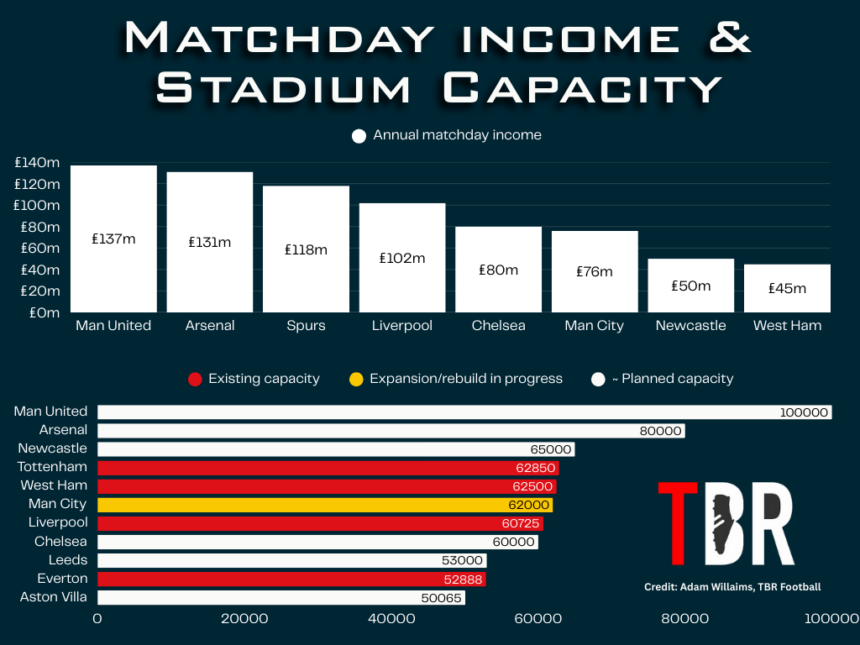

With Everton set to move into a new commercially lucrative stadium, Aston Villa and Leeds planning major expansion, and – most significantly – Manchester United aiming to build Europe’s biggest arena, matchday income is suddenly important again in the Premier League

Arsenal can’t afford to stand still. Even in North London, they have been left behind by Tottenham, whose stadium is very slightly bigger but more far more lucrative in terms of non-football events.

Credit: Adam Williams/TBR Football/GRV Media

If it came down to gate receipts alone, the Gunners would be on top of the pile. Arsenal generated £132m matchday income in 2023-24, capitalising on their return to the Champions League and increased appetite from the lucrative hospitality sector. That was the highest in the Premier League both in total and on a per-fan basis.

There’s absolutely nothing wrong with their commercial operation on matchdays, but the facility itself could be put to better use. The Tottenham Hotspur Stadium has the edge when it comes to hosting the biggest concerts, the NFL, and other commercial events. That was worth £60m to them last season alone, compensating for a lack of European football.

Arsenal have plenty of headroom under Profit and Sustainability Rules (PSR) but the Kroenkes want the club to self-fund, not continue to rely on them underwriting year-on-year financial losses.

That means stadium income is central to Mikel Arteta’s transfer budget, just as it was for Arsene Wenger when Arsenal moved from Highbury before Roman Abramovich blew the system wide open.

And Arsenal are planning on expanding capacity at the Emirates to 80,000, as Josh Kroenke first intimated last summer, and have now been presented with a number of design concepts.

Stam Kroenke made his billions in property and his sports empire is literally and figuratively built on bricks and mortar.

And his latest project could give some indication of what he would like to do with the Emirates.

Stan Kroenke unveils Ball Arena plans

As well as the SoFi Stadium, the home of the LA Rams which is routinely described as the world’s best stadium, Kroenke owns Ball Arena in Denver.

The stadium complex houses his Denver Nuggets NBA franchise and the NHL’s Colorado Avalanche. It is now due for a revamp, with the surrounding area due for billions of dollars worth of redevelopment.

Kroenke his this week unveiled official plans for a mixed-used commercial and residential site adjacent to the stadium, which includes a hotel, two 12-story blocks of flats, a 5,000-seat mini venue and retail spaces. This latest development is part of a broader project two redevelop 60 acres of land currently being used as a parking lot.

There will always be five bridges, 10 acres of open space and miles of bike lanes and other infrastructure.

Kroenke will likely secure a tranche of public money for the redevelopment, just as he would like to do at Arsenal.

But the new development also highlights just how different the Emirates site is to his projects in the US.

In N5, it’s hard to find a few square metres of space, let alone nearly 60 acres, so the design team will ned to innovate to maximise the little room they have.

But Kroenke likes to use sports as a launch pad for broader real estate and commercial aims.

Can Arsenal become consistently profitable under KSE?

If Kroenke is to realise his ambitions to make Arsenal consistently profitable, it’s likely that the real estate aspect of the project will be central to his vision.

Tottenham have proven that, even in an era of soaring media rights and emphasis on boosting commercial performance through digital, physical infrastructure is still king. Spurs commercial and matchday income have trebled since the move away from White Hart Lane.

Arsenal would only be adding 20,000s seats at the Emirates Stadium but there is every reason to believe that the development will have an outsized financial impact.

Hospitality is one area that most clubs are targeting, with the idea of retaining the atmosphere at the ground while accommodating tourists and high-paying guests.

The wider matchday experience – food and drink, retail etc – will also be a target area. In recent years, Arsenal have lagged behind the rivals as far as commercial income is concerned.