With every trophyless season, the Tottenham fanbase loses more Daniel Levy apologists. With the Spurs’ chairman searching for fresh investment, how long is left in this unhappy marriage?

It would be fascinating to see what a Europa League triumph would do for Daniel Levy’s legacy in North London, especially one that coincides with Tottenham potentially finishing 17th in the Premier League.

Ange Postecoglou’s side beat Bodo/Glimt 3-1 in the semi-final first leg last night, putting them in a commanding position ahead the trip the Arctic Circle next Thursday. In Bilbao in three weeks time, they hope they will have the chance to rescue their season – and potentially ENIC’s financial exposure.

Champions League qualification has never been more lucrative, especially for English clubs, who are favoured under UEFA’s distribution for the new 36-team format, which Levy lobbied for.

Without lucrative European football, ENIC will surely have to either money into the club, make use of their revolving credit facility (their overdraft, basically), or hope whoever is in charge of football operations going into 2025-26 is able player-trade their way to a better squad without external funding. Given what we’ve seen from Tottenham this season, that would be a miraculous feat of alchemy.

Incidentally, TBR Football understands that Fabio Paratici will return to Spurs in an official capacity this summer following the expiry of his ban from football. The Italian will have the final sign-off on Postecoglou’s replacement. What this means for sporting director Johan Lange and chief football officer Scott Munn remains to be seen.

Once Postecoglou’s successor is in situ, Spurs will have had six permanent managers since the move away from White Hart Lane. Tottenham 2.0, housed at a money-printing new stadium fit for one of the world’s best clubs, wasn’t supposed to look like this.

Credit: Adam Williams/TBR Football/GRV Media

Joe Lewis isn’t around to take responsibility following his conviction for insider trading in 2022, nor is any other senior figure from Tavistock Group, the Bahamas-headquartered company that owns ENIC whose exco is staffed with Lewis and Levy family members. The buck, therefore, stops with the chairman.

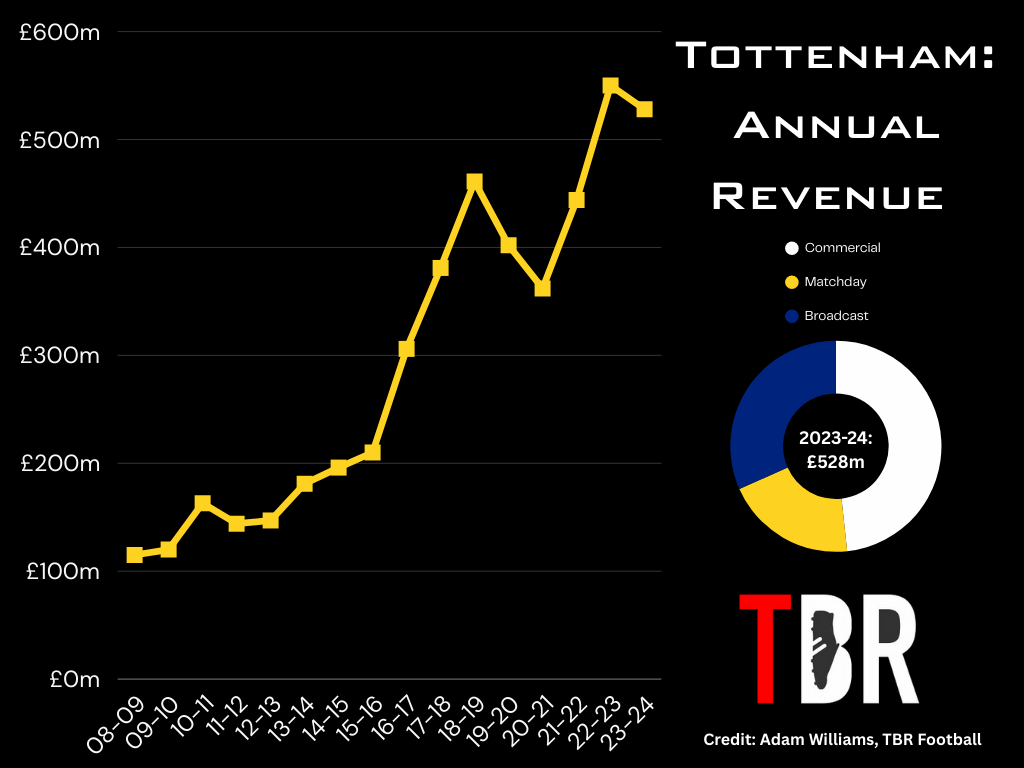

The corporate know-how is there in spades. Levy has the stadium debt set up perfectly, while the club’s flagrantly commercial turn since 2019 has seen sponsorship and retail revenues boom. What is missing is the football vision. Spurs have lurched from one idea to the next with no pay-off.

Fresh ideas are needed. Perhaps fresh investment is the only way to deliver them.

Daniel Levy not making Tottenham attractive to investors, says Kieran Maguire

Tottenham have been exploring external investment options for years.

Most of Levy’s personal wealth is tied up in Spurs. ENIC meanwhile have departed somewhat from Spurs’ self-funding model in recent years, with two separate equity injections totalling around £185m coming in 2022 and 2024 respectively.

They are reticent to put any more money in so, in Levy’s own words, are “looking to expand their capital base.” In layman’s terms, that means either a full or part-takeover.

Former Newcastle supremo Amanda Staveley has been linked with Tottenham. The financier is said to have raised £500m for a new football project through her PCP Capital Partners investment vehicle.

Elsewhere, several groups and private individuals have been linked with full takeover offers. Perhaps most tantalisingly for fans, rumours of Qatari sovereign wealth’s interest in Spurs persist.

But there are opportunities elsewhere in football finance. AC Milan, for example, are expected to come on the market soon. Real Madrid meanwhile are looking to change their constitution to allow private investment. In the Premier League, most owners in the so-called Big Six will be looking for an exit at some stage. So how do Spurs, who Levy values at £3.75bn, stand out?

“The plus points of the future prospects of Spurs are that they are an elite club, even if its record in trophies suggests otherwise” says University of Liverpool football finance lecturer Kieran Maguire, speaking exclusively to TBR Football.

| Club | Major honours since Tottenham last won a trophy |

| Man City | Premier League (8), FA Cup (2), League Cup (6), UEFA Champions League (1), Super Cup (1), Club World Cup (1) |

| Man United | Premier League (4), FA Cup (2), League Cup (4), UEFA Champions League (1), Club World Cup (1), UEFA Europa League (1) |

| Chelsea | Premier League (3), FA Cup (4), League Cup (1), UEFA Champions League (2), Europa League (2), Super Cup (1), Club World Cup (1) |

| Liverpool | Premier League (2), FA Cup (1), League Cup (3), UEFA Champions League (1), Super Cup (1), Club World Cup (1) |

| Arsenal | FA Cup (4) |

| Leicester City | Premier League (1), FA Cup (1) |

| Wigan | FA Cup (1) |

| Portsmouth | FA Cup (1) |

| Birmingham | League Cup (1) |

| Swansea | League Cup (1) |

| West Ham | Conference League (1) |

| Newcastle | League Cup (1) |

“It has huge investment in infrastructure. If you take a look at United, the big upgrades still need to be paid for as far as the stadium is concerned. It’s a bit like buying a new house where they have just put in a sauna, a gym, an extension – they will all be factored into the price.

“Daniel Levy is showing no interest in making Spurs attractive, however.

“A minority investor? Perhaps, though a minority investor would want some kind of non-fiscal return on investment initially and, given Levy’s tight grip on operations at Spurs, that would be a relationship that would struggle to work.

“Spurs would be attractive but there are pricing issues and control issues. Levy is the biggest asset and the biggest liability at that club in that sense.”

Are Spurs really worth £3.75bn?

Football club valuations have trended up and to the right for about a decade now.

But still, Premier League clubs and their counterparts on the continent continue to lose money. Even in the rare event that a club is consistently profitable, the owners reinvest the surpluses in the business. In short, no one – except agents and players – is making any money.

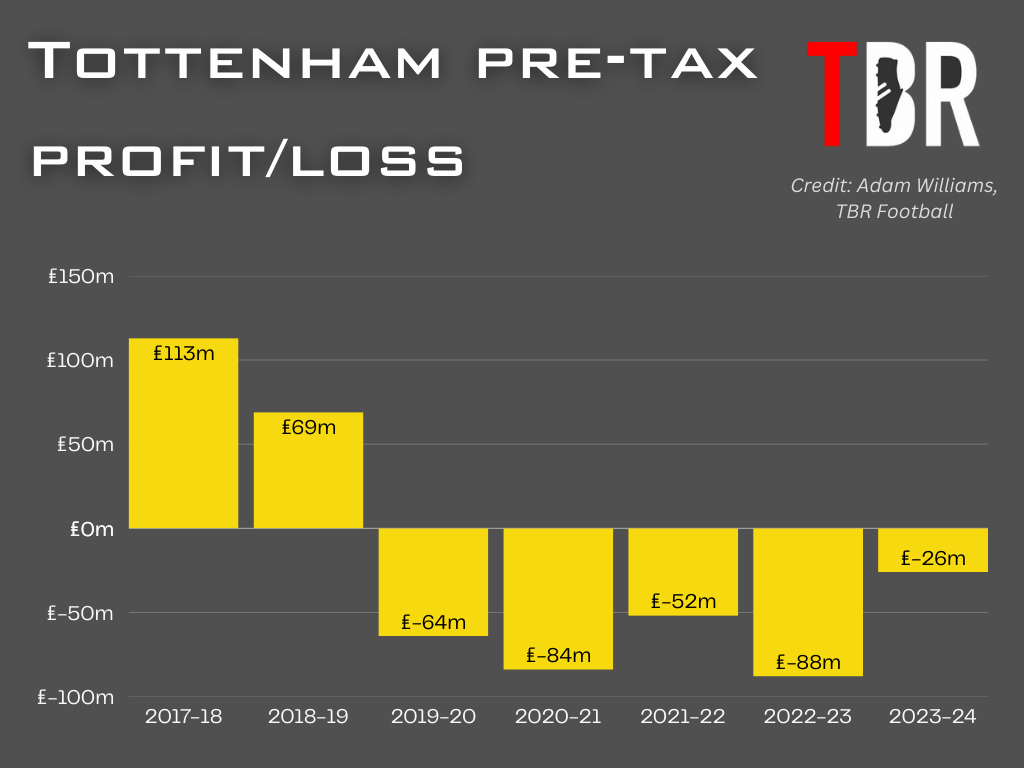

Tottenham are held up as an example of one the best run clubs in Europe from a financial perspective but even they are now in the red. Even accounting for non-cash expenses like depreciation and amortisation, they are running a cash deficit each season.

So who in their right mind would invest £3.75bn to buy them?

Credit: Adam Williams/TBR Football/GRV Media

The faith among investors is that clubs will one day turn a corner. Most investors evangelise about how technology can help them scale businesses commercially and one day allow them to skim off the top of profits. There is an increasing emphasis on bricks-and-mortar developments too, with football clubs position at the centre of Disney Land-style complexes that generate revenues far higher than stadiums have done traditionally.

| Rank | Club | League | Country | Value | 1-y value change (%) | Revenue | Operating income |

| 1 | Real Madrid | Spanish La Liga | Spain | £5.18bn | 9 | £685m | £60m |

| 2 | Manchester United | English Premier League | England | £5.14bn | 9 | £616m | £147m |

| 3 | Barcelona | Spanish La Liga | Spain | £4.39bn | 2 | £660m | £-114m |

| 4 | Liverpool | English Premier League | England | £4.21bn | 2 | £565m | £80m |

| 5 | Manchester City | English Premier League | England | £4.01bn | 2 | £683m | £111m |

| 6 | Bayern Munich | German Bundesliga | Germany | £3.93bn | 3 | £613m | £66m |

| 7 | Paris Saint-Germain | French Ligue 1 | France | £3.45bn | 4 | £592m | £-99m |

| 8 | Tottenham Hotspur | English Premier League | England | £2.51bn | 14 | £522m | £126m |

| 9 | Chelsea | English Premier League | England | £2.46bn | 1 | £487m | £0m |

| 10 | Arsenal | English Premier League | England | £2.4bn | 15 | £617m | £110m |

But the golden goose is surely cost controls. If Spurs were in the NFL, NBA or NHL, a system of salary caps, luxury taxes, discovery rights and central infrastructure funds would, in tandem with the closed-loop system in American franchise sport, guarantee profits.

Profit and Sustainability Rules (PSR) are a weak, weak imitation of these systems. They haven’t curbed wage and transfer inflations anywhere near as much as the Premier League or UEFA would have liked.

Until there is either a cultural change within football and a more disciplined, collectivist class of investors emerge or stricter spending limits are imposed, it’s hard to see how Spurs can justify a £3.75bn valuation.

The trump card, as ever, is sovereign wealth. For these funds, a return on investment is secondary to the prestige that owning a sporting institution delivers. That is why they are the golden ticket for those fans who want retail therapy in the transfer market, not a sustainable football club.