For FSG, days like Liverpool’s Premier League coronation against Tottenham two Sundays ago are nice-to-haves but are ultimately secondary to what will be the biggest event in their time at Anfield: payday.

To date, FSG have taken almost no money out of Liverpool. On a net basis, they are way, way down on the £300m deal that saw them take over from Tom Hicks and George Gillett in 2010. The odd trivial management fee paid to FSG here and there has been swallowed up hundreds of times over by the money they have invested to expand Anfield.

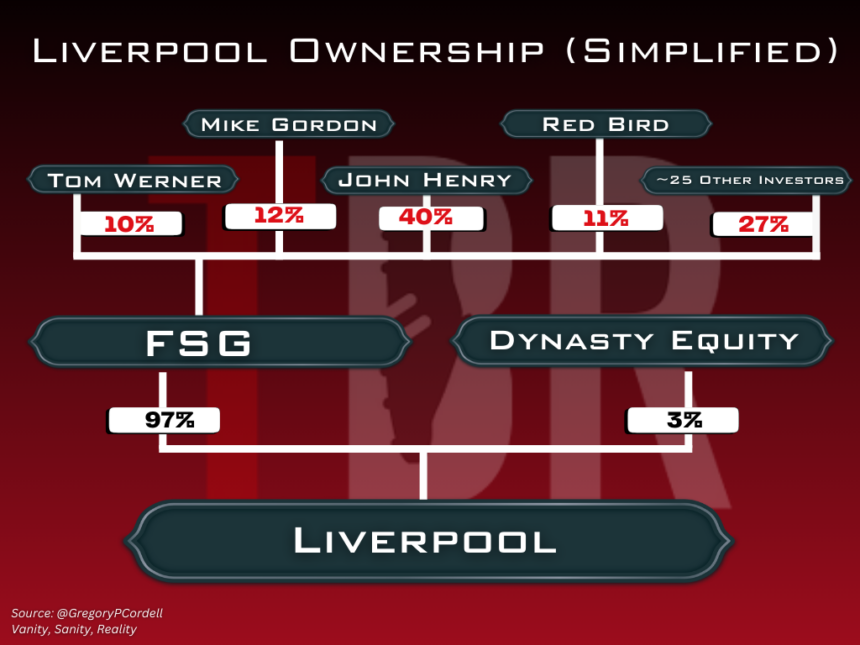

Even the £127m FSG received for selling a three per cent stake in the club to Dynasty Equity in 2023 was revealed in the club’s most recent set of accounts to have been reinvested in the club, albeit to pay down bank debt taken out under FSG.

Credit: Adam Williams/TBR Football/GRV Media

The Boston-based ownership have managed to scale the club commercially and deliver nine items of silverware, including only a second title in the Premier League era, without investing a penny in the football side of the business.

And while they continue to post operating losses and have one of the lowest EBITDAs (earnings before interest, tax, depreciation and amortisation – a metric often used as a more reliable measure of business performance than profit-and-loss), FSG’s investment continues to appreciate in value.

They came close to that multi-billion-pound payday in 2022. It was not a coincidence that they announced their intentions to sell the club shortly after the European Super League, which John Henry had a key role in designing, folded.

Credit: Adam Williams/TBR Football/GRV Media

They had to re-engineer their entire business model that day in April 2021. Of you were a Liverpool fan who helped destroy that breakaway project, it was a triumph. For FSG, it was almost an extinction-level event.

In the end, of course, FSG changed course, deciding to sell only a tiny stake to Dynasty Equity, not a majority holding in the club or a significant minority stake a la the Glazers with Sir Jim Ratcliffe at Manchester United.

The message, one delivered after some post-Super League soul searching, was that there is plenty more upside for FSG at Anfield.

With another Premier League title on the bag, how much closer are the owners to ‘exit value’?

- READ MORE: Arne Slot needs to sell £40m Liverpool player who failed to take his chance against Chelsea

Liverpool staff shed light on FSG’s capital appreciation model

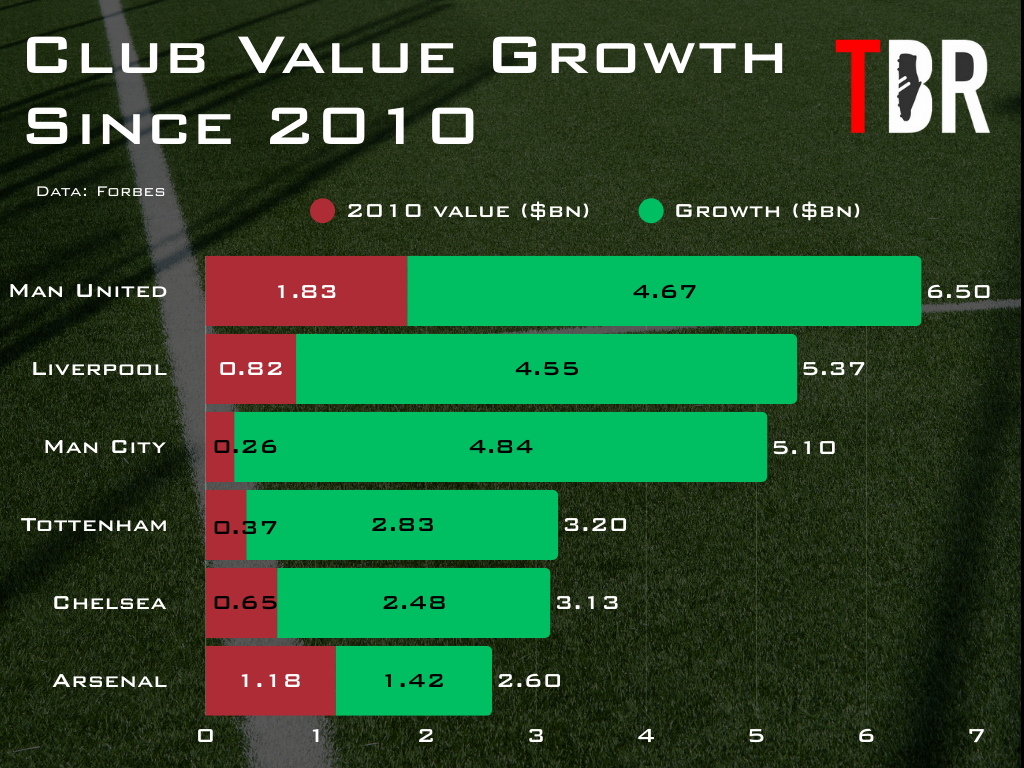

While most Liverpool fans were consumed by the glory of the occasion, FSG will have been wondering what another Premier League title and the brand benefits that brings means for the club’s enterprise value. Even if Fenway were to sell at the very low end of the spectrum they would have achieved achieved an astonishing markup on their initial £300m investment.

Ultimately, this is the aim. FSG want to increase the value of their asset, reinvesting profits and subsidising only when absolutely necessary before eventually flipping it for a profit.

Club owners are loath to talk about the grand vision and how they plan to make money from their investment. But generally speaking, they can either skim profits off the top or adopt the above capital appreciation method.

It would take an awfully long time for John Henry and Tom Werner – both of whom are now 75 years old – to generate nearly enough profit to justify not selling the club at the valuations talked about.

Now, activity within the clubs suggests there is recognition that capital appreciation, not dividends, is the name of the game.

Several senior Liverpool staff including commercial director Kate Pratt Theobald and senior partnerships manager Jack Best have liked a LinkedIn post suggesting that the club’s value has surpassed £4.5bn.

The post from The Investment League also suggests that Liverpool could take on more external investment to help further boost their value. And though interacting positively with the post can hardly be seen as an endorsement of that view, it does signal that there awareness that FSG are looking to increase the size of the pie ahead of a sale one day.

Kieran Maguire football finance analysis: How much are Liverpool really worth?

Measuring a club’s value is far from being n exact science.

In fact, there are many experts that believe that the franchise value of Premier League and European clubs in particular is a false market due to due non-existent cost controls, the high-risk sporting structure inherent in football, and the current lack of a pathway to sustained profitability.

Liverpool are a global brand, but can that be monetised too the extent that a £6bn valuation – which is what some outlets have appraised the club at – is justified?

“Trying to work out an appropriate multiplier in the current market is very difficult,” says Kieran Maguire, the University of Liverpool football finance lecturer in exclusive conversation with TBR Football.

“We have seen sales of US franchises increase significantly in the last two or three years. They have the benefit of scarcity.

“Football clubs, however, have the benefit of globalisation to a greater extent than the NFL. The downside of football is that cost control is still an ongoing issue as far as owners are concerned. Those costs are now being pushed through to fans in the shape of higher ticket prices.

“Two or three years ago, I think we’d have said Liverpool are worth £3bn. With the Ineos deal at Man United valuing at £5-5.5bn, there is certainly scope to increase Liverpool’s value. Liverpool is fantastically well-run football club, it’s more efficient and has a much better culture than Man United. We always say that culture trumps strategy. Liverpool has two advantages here – they have a culture and a strategy, unlike what we can see at United so far.

“Those are the positives. Liverpool would be seen as a very attractive proposition and you would have to pay a trophy-asset premium on top of that. £6bn I think is probably pushing it because, ultimately, the club isn’t generating profits. It is broadly breaking even on an operational basis, so what is in it for a prospective owner other than the kudos and being able to flip it for a profit?

“There is still a belief among US investors in particular that, if you can’t get the people to Liverpool, can you get Liverpool to the people? That can be achieved in one of two ways. First of all, there is a belief in the metaverse. That hasn’t come good yet. The jury is still out there.

“Replicating the NFL model of matches taking place overseas is another opportunity, but that would likely move the dial in single millions rather than billion-pound increases in value. So, it is difficult to come out at a figure of £6bn based on any traditional financial evaluation metrics, but it depends what assumptions you use.

“Unlike NFL, NBA and so on, what you don’t have is a hive mind in terms of ownership. You have different kinds of owners competing in the same market – some want trophies, others are profit maximisers. It’s like two oceans meeting.”