The shrapnel from Manchester City’s legal case against the Premier League has ripped through the football finance ecosystem, with Arsenal among those in the blast zone.

It has been over two years since the Premier League charged Man City with over 100 counts of financial wrongdoing, ranging from disguising the true sources of commercial income to paying players and managers via parallel contacts so as to bypass PSR (Profit and Sustainability Rules). Incidentally, ‘115’ was the number that stuck because of an error in the league’s initial communications. In actual fact, the number is closer to 130.

It has now been over five years since UEFA banned Man City from the Champions based on similar accusations, a decision which was later overturned in the Court of Arbitration for Sport.

In that last half decade, Arsenal have emerged as a genuine rival to their norther counterparts, both in competitive and emotional terms.

As well as finishing runners-up in to City the last three completed seasons (incidentally, four 2nd-place finishes in a row would be an unwanted Premier League record), the executive team oversee by Stan Kroenke cannot stand what City’s ownership model represents. The players don’t like each other – and nor do the suits.

The Gunners have suffered more than most as a result of Man City’s rise since the Abu Dhabi-financed takeover in 2008.

| Position | Team | Played MP |

Won W |

Drawn D |

Lost L |

For GF |

Against GA |

Diff GD |

Points Pts |

| 1 | 35 | 25 | 7 | 3 | 81 | 35 | 46 | 82 | |

| 2 | 35 | 18 | 13 | 4 | 64 | 31 | 33 | 67 | |

| 3 | 35 | 19 | 7 | 9 | 67 | 43 | 24 | 64 | |

| 4 | 35 | 19 | 6 | 10 | 66 | 45 | 21 | 63 | |

| 5 | 35 | 18 | 9 | 8 | 62 | 41 | 21 | 63 | |

| 6 | 35 | 18 | 7 | 10 | 54 | 42 | 12 | 61 |

The North Londoners have had to abandon their self-funding model to remain competitive against a rival backed by near-limitless hydrocarbon reserves, who – before Financial Fair Play and later Profit and Sustainability Rules were introduced – were allowed to spend freely. Indeed, the early years of Sheikh Mansour’s reign saw City pilfer many of Arsenal’s best players. ‘If you can’t beat them, buy them’ – that was the philosophy, and it worked.

City have dominated the 2010s and 2020s. Even this season, which has been seen as a disaster, may well culminate in Pep Guardiola’s side winning the FA Cup, matching the sum total of Arsenal’s silverware haul under Mikel Arteta.

For their part, Arsenal have enjoyed a resurgence in recent years. Ultimately, their domestic performance has regressed in 2024-25, but their run to the Champions League semi-finals where they will attempt to overturn a one-goal deficit against Paris Saint-Germain tomorrow night has galvanised the club.

If Arsenal are eliminated at Parc de Princes tomorrow night, however, Stan and Josh Kroenke will consider it cruelly fitting that it will be against another team backed by another Gulf state autocracy.

The difference is that while City have been similarly extravagant with their spending, PSG have historically been mind-meltingly inefficient with the resources at their disposal.

On the flip side, many Arsenal fans will argue that a genius football vision has been supplemented by cheating along the way. City say they have irrefutable evidence that that is not the case.

Whatever the truth, the saga has riven the Premier League and European football in two – and the fallout is spreading.

Football finance expert explains impact of Man City case on Arsenal, explains latest in 115 charges

In the last financial year, the Premier League’s administrative expenses increase by almost 100 per cent to over £200m. That cost will be entirely borne by all 20 Premier League clubs.

At least £45m of that is said to be legal costs associated with the 115 charges case. With the tribunal having retired to consider their verdict and an appeals process almost certainly looming, the final figure will be far higher.

One of the tangential impacts is City’s counteroffensive, which has seen them challenge the Premier League’s Associated Party Transaction (APT) rules in the arbitration courts.

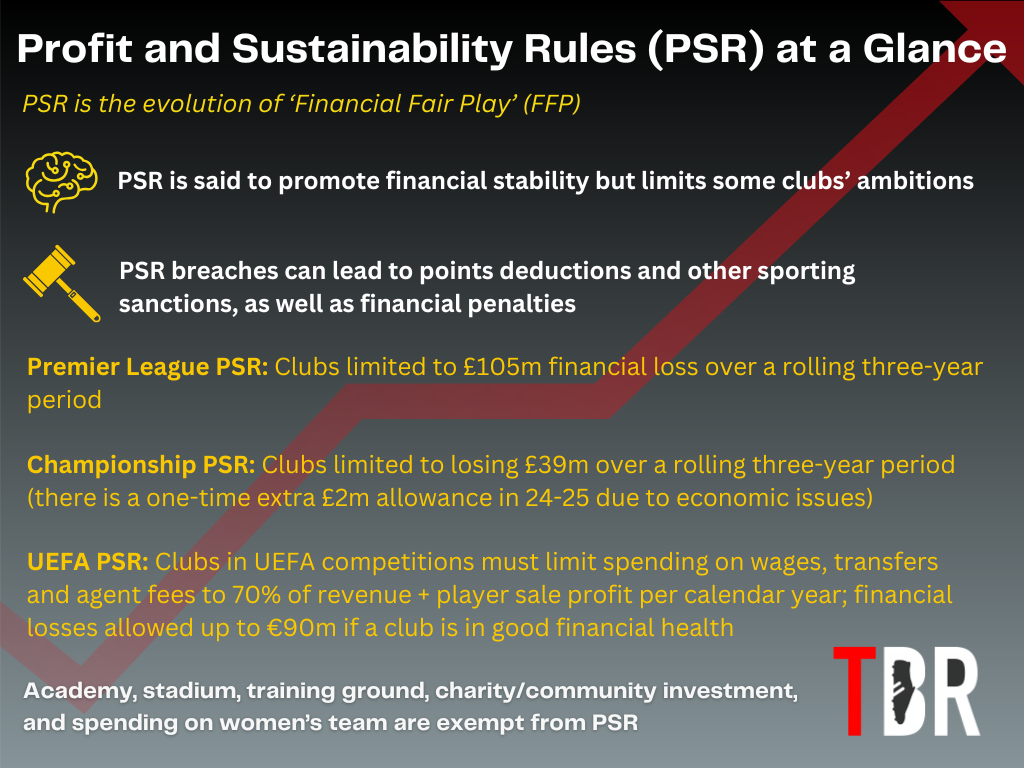

The APT Rules succeeded the previous Related Party Transaction Rules and were introduced in the wake of the Saudi Public Investment Fund’s takeover of Newcastle United in 2021. In short, they deem that any deal between a club and an entity linked to that club’s owner should be screened for fair market value, with the aim of preventing clubs from artificially inflating their revenue for the purposes as PSR.

Khaldoon Al-Mubarak’s lawyers have successfully argued that financial loans from shareholders to their clubs should also be treated as a subsidy and, in the case where the loans have zero or low interest, should therefore have a notional interest rate applied for PSR.

After claiming victory in that case, City now want the rules applied retroactively. That would impact Arsenal, who now have the highest shareholder loans in the Premier League at £324m.

Speaking exclusively to TBR Football, University of Liverpool football finance lecturer Kieran Maguire offered his analysis on what a retroactive application of the APT Rules might mean for Arsenal. He also gave an update on the mood music surrounding City’s ‘115’ charges case.

“Arsenal had a net interest cost of £5m in 2022 and £6m in 2023,” said the Price of Football author.

“The Kroenke loans aren’t that critical in the overall picture, so I don’t see this is as being an issue.

“There is a broader issue in the sense that City and Arsenal are the best of enemies. It’s very, very personal between the two clubs. This is an opportunity to score points against Arsenal and protect their own interests as far as City are concerned.

“I think we will see some sort of transitional rule with the APTs. We have already seen Brighton’s loans from Tony Bloom have been converted into something that is between shares and debt.

“There will be discussions taking place between clubs, lawyers and accountants as to how existing loans can be reclassified as equity. Therefore, that will assist things going forward.

“I think, based on historical evidence, that City have got the upper hand over the Premier League. Nick DeMarco thinks it will be a score draw where the Premier League will win some of the 115 charges but City will have a far stronger case in others.”

Will PSR stop Arsenal from spending big this summer?

Andrea Berta, Arsenal’s new sporting director, has a reputation as a top player trader. Historically at Atletico Madrid, his focus has been on the outdoor as well as the indoor.

That has led some Arsenal fans to speculate that PSR may mean they take a sell-to-buy approach in the transfer market this summer.

Let’s look at the facts.

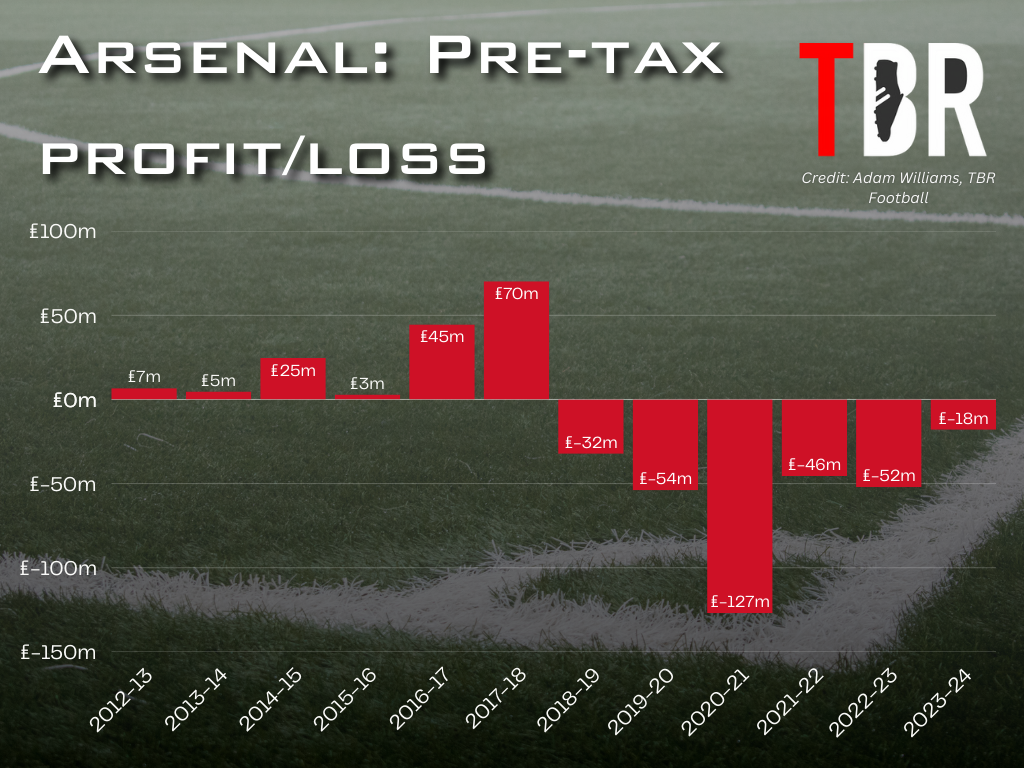

Arsenal lost just less than £18m in the last financial year, 2023-24. That deficit was down on the £52m they lost the previous season.

Significantly, the 2022-23 loss is now no longer part of the Premier League or UEFA’s thee-year PSR/FFP monitoring period.

What’s more, last season’s £18m loss will probably turn into a break-even result when PSR-exempt expenses like academy and women’s team spending are deducted. In 2024-25, they will return to profit thanks to an enormously lucrative Champions League and the ‘pure profit’ sales of academy products Emile Smith Rowe and Eddie Nketiah.

Credit: Adam Williams/TBR Football/GRV Media

That gives them the headroom to post a huge loss in 2025-26 without breaching Premier League’s three-year limit of £105m or UEFA’s equivalent of around £65m for clubs deemed in good financial health, which Arsenal are.

UEFA’s squad cost control rules might be somewhat tighter. European football’s governing body now limits spending on football player and staff wages, transfers and agents’ fees to 70 per cent of turnover plus profit on player sales.

But again Arsenal will have ample headroom to spend here too, thanks chiefly to their profit on player sales and likely revenues of around £700m.

So if Stan Kroenke fails to sign a striker of the calibre of Alexander Isak, Nico Williams or Benjamin Sesko, it won’t be because of PSR constraints.

The owner wants Arsenal to return to a self-sufficient business model, however. Eventually, that will mean not underwriting lavish transfer spending with shareholder loans or cash injections.