In 2001, when ENIC and Daniel Levy took over Tottenham, buying a Premier League football club got you the players, the stadium, and a modest retail operation.

In 2025, owning a Premier League team grants you instant celebrity status, a direct line to world leaders, and regular sit-downs with the richest people on the planet in your rival club shareholders.

Tottenham in 2001 were worth about £30m, give or take. Today you can add a zero to that. And when you’re done doing that, add another one.

Even allowing for two decades’ worth of inflation, it’s a quite astonishing markup. All this for a club who could finish one place outside the bottom three under Ange Postecoglou this season, albeit with a potential season-salvaging Europa League final against Manchester United to come.

| Position | Team | Played MP |

Won W |

Drawn D |

Lost L |

For GF |

Against GA |

Diff GD |

Points Pts |

| 14 | 36 | 12 | 5 | 19 | 51 | 64 | -13 | 41 | |

| 15 | 36 | 10 | 10 | 16 | 42 | 59 | -17 | 40 | |

| 16 | 36 | 10 | 9 | 17 | 42 | 53 | -11 | 39 | |

| 17 | 36 | 11 | 5 | 20 | 63 | 59 | 4 | 38 | |

| 18 | 36 | 4 | 10 | 22 | 35 | 77 | -42 | 22 | |

| 19 | 36 | 5 | 7 | 24 | 31 | 78 | -47 | 22 | |

| 20 | 36 | 2 | 6 | 28 | 25 | 82 | -57 | 12 |

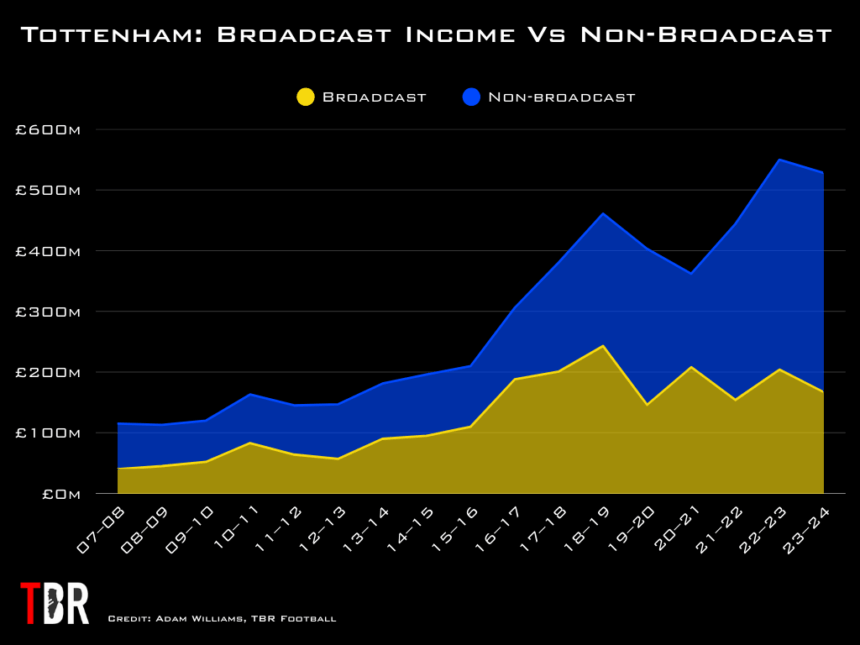

The appreciation in value is down to a number of factors, the most obvious being the boom in broadcast rights in the last 25 years. In its next rights cycle, the Premier League will distribute £12.25bn to clubs from its domestic and international media deals.

That’s higher than the GDPs of North Korea, Afghanistan, Monaco, Kosovo, Rwanda and 49 other countries on earth, based on IMF data.

In 2023-24, Spurs’ total media income – from both the Premier League and UEFA – was £204m, over five times as much as their total turnover in 2001.

Factoring in commercial income too, total revenue in the last financial year was almost exactly 11 times what it was when ENIC took over the club.

Credit: Adam Williams/TBR Football/GRV Media

Under Daniel Levy, Tottenham are also either the most profitable or second-most profitable club in Premier League history, depending on which metric you use.

The growth in their enterprise has been down to external factors, yes, but also the owners’ superb scaling of the club as a brand.

The vision to build a new multi-function stadium, the merchandise and sponsorship work, and the expansion of Spurs’ digital presence have all put the club in a position where glory on the pitch should be attainable.

They have been let down by poor footballing decisions, of course, but an incoming investor would look at the underlying numbers, not the trophy cabinet.

| Club | Major honours since Tottenham last won a trophy |

| Man City | Premier League (8), FA Cup (2), League Cup (6), UEFA Champions League (1), Super Cup (1), Club World Cup (1) |

| Man United | Premier League (4), FA Cup (2), League Cup (4), UEFA Champions League (1), Club World Cup (1), UEFA Europa League (1) |

| Chelsea | Premier League (3), FA Cup (4), League Cup (1), UEFA Champions League (2), Europa League (2), Super Cup (1), Club World Cup (1) |

| Liverpool | Premier League (2), FA Cup (1), League Cup (3), UEFA Champions League (1), Super Cup (1), Club World Cup (1) |

| Arsenal | FA Cup (4) |

| Leicester City | Premier League (1), FA Cup (1) |

| Wigan | FA Cup (1) |

| Portsmouth | FA Cup (1) |

| Birmingham | League Cup (1) |

| Swansea | League Cup (1) |

| West Ham | Conference League (1) |

| Newcastle | League Cup (1) |

So why, after years of searching, has Levy been unable to find a buyer for Spurs?

The latest data might explain the hold-up.

Tottenham takeover value assessed, Daniel Levy’s asking price too high

Officially, Tottenham have been courting new investment since last April, though the search has in fact been going on far longer.

Amanda Staveley has been linked with a part-takeover of Spurs, while Todd Boehly held talks with Levy before investing in Chelsea. Qatari sovereign wealth is always in the conversation too.

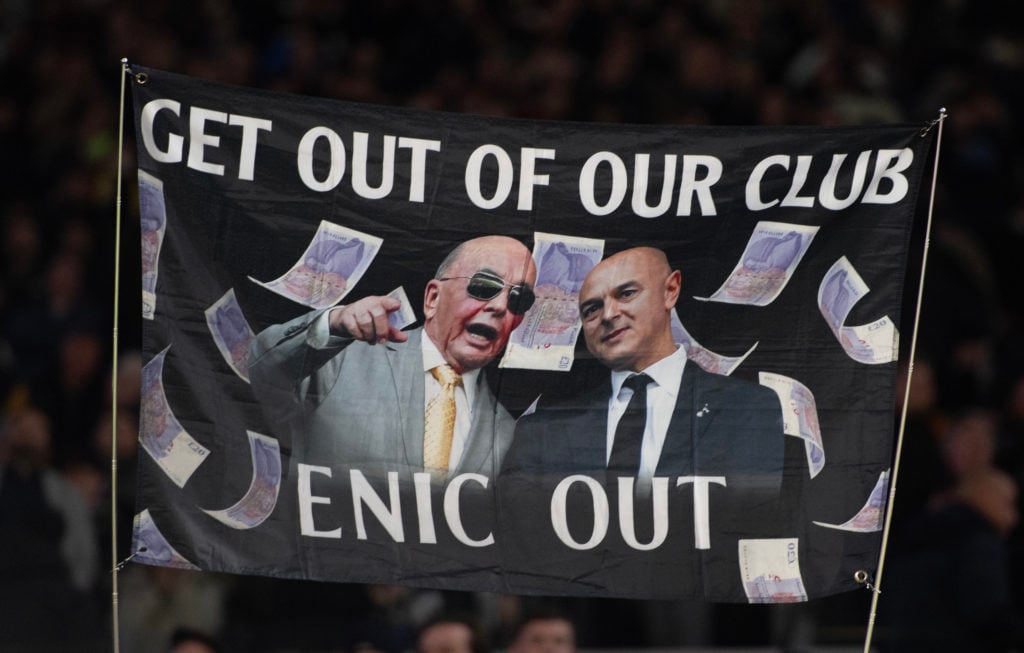

As the North Londoners’ performances on the pitch have slid this season, calls for Joe Lewis’ family trust and Levy to leave the club have grown louder.

But there have been next to no concrete updates in coming up to a year and, significantly, there was no mention of the search for investment in the club’s latest financial statements.

Levy is said to value Spurs at £3.75bn, with any minority investment required to meet that appraisal.

The latest figures from football finance industry experts Sportico suggest that is wildly above the club’s true worth. Based on their analysis, Tottenham are the 9th most valuable club in the world at £2.64bn.

| Rank | Club | Value | Revenue (23-24) |

| 1 | Real Madrid | $6.53 billion | $1.13 billion |

| 2 | Manchester United | $6.09 billion | $834 million |

| 3 | FC Barcelona | $5.71 billion | $802 million |

| 4 | Liverpool | $5.59 billion | $773 million |

| 5 | Bayern Munich | $5.21 billion | $827 million |

| 6 | Manchester City | $5.16 billion | $901 million |

| 7 | Arsenal | $4.49 billion | $773 million |

| 8 | Paris Saint-Germain | $4.26 billion | $873 million |

| 9 | Tottenham Hotspur | $3.68 billion | $652 million |

| 10 | Chelsea | $3.57 billion | $590 million |

The pool of investors who can afford to spend £2.64bn on an asset which, for the foreseeable future, will not yield a cash return is vanishingly small.

However, Chelsea’s takeover at £2.5bn has proven there is an appetite from certain sectors and soothed anxieties that Premier League clubs as an asset class could be a false market.

Sir Jim Ratcliffe’s part-takeover of Manchester United meanwhile also suggests that Spurs could bring on a minority investor if Levy is willing to cede significant operational control.

Speaking exclusively to TBR Football earlier this year, University of Liverpool football finance lecturer Kieran Maguire was sceptical about that kind of arrangement, however.

“Given Levy’s tight grip on operations at Spurs, that would be a relationship that would struggle to work,” he said.

“Spurs would be attractive but there are pricing issues and control issues. Levy is the biggest asset and the biggest liability at that club in that sense.”

Could French finance crisis unlock Qatar-backed Tottenham takeover?

For many supporters who have seen Manchester City’s success under Abu Dhabi and Newcastle United’s rise since the Saudi Public Investment Fund’s takeover, Middle Eastern sovereign wealth is the dream ticket.

Ethical concerns aside, Gulf states simply have deeper pockets and greater networks than anything in the private sector. So when Qatar Sports Investments were linked with Spurs, some fans were elated.

Those stories appear to have gone cold, but the Qataris are inscrutable investors and clearly have not given up on football after the World Cup in 2022. Given their existing influence in London, Tottenham would make sense as a potential acquisition.

However, UEFA’s rules on dual ownership could prove a sticky wicket. Two clubs under the same ownership regime are not allowed to compete in the same competition, which would be a problem if PSG and Spurs were both Qatar-owned.

However, the collapse of Ligue 1’s £1.7bn TV deal with DAZN is expected to have many investors questioning their future in French football.

If PSG win the Champions League this year, Qatar Sports Investments may want to create a European dynasty to further enhance their image in the sport, but it’s also feasible that they may begin to think about divesting their interests in the club.

There have been reports to that effect in recent months and years, and QSI sold a minority stake to private equity firm Arctos in 2023. If they continue to down this path, it’s conceivable it could open the door for a full Spurs takeover at some point in the future.