The Emirates Stadium has had a new lease of life in recent years, even if 2024-25 didn’t end how Arsenal – who are working on plans to expand the ground – would have liked.

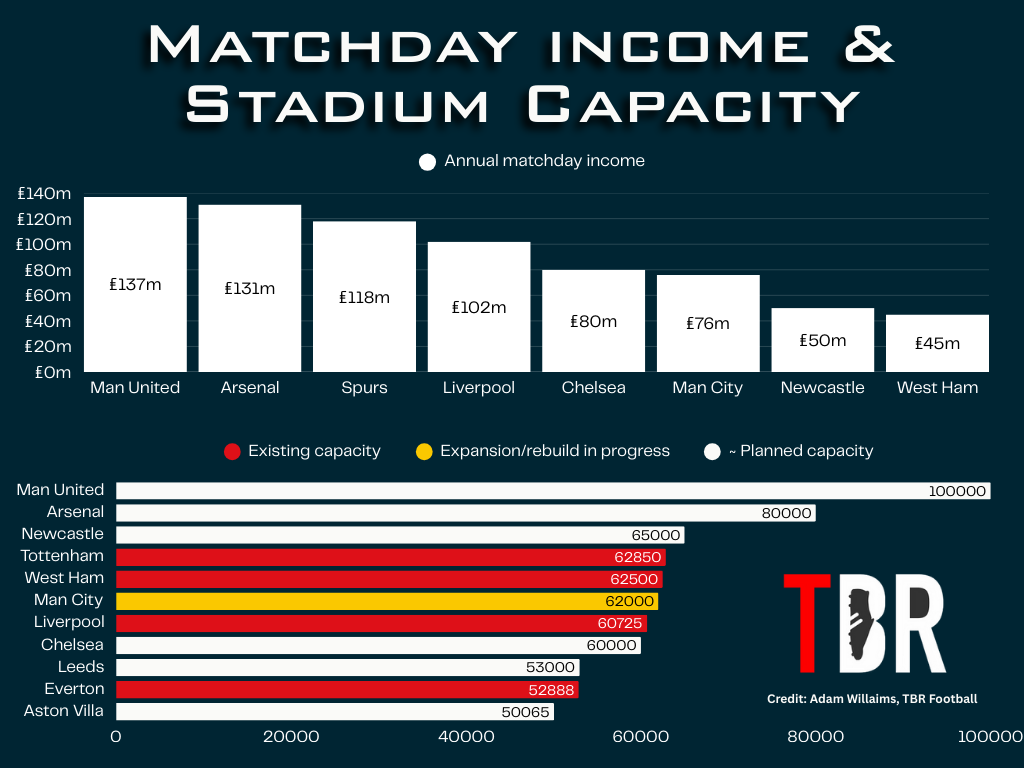

For all the justified praise that North London rivals Tottenham have received for the vision required to build their new stadium, Arsenal earned more in matchday income in the latest financial year.

Granted, that was primarily because the Gunners were in the Champions League whereas Spurs had no European football, but it does illustrate that the Emirates isn’t outdated just yet.

Opened in 2006, the stadium was meant to be the golden asset that made Arsenal financially self-sufficient. But Premier League football has changed almost beyond recognition since then, with the influx of global capital amplifying competition and the costs required to compete at the top of the table.

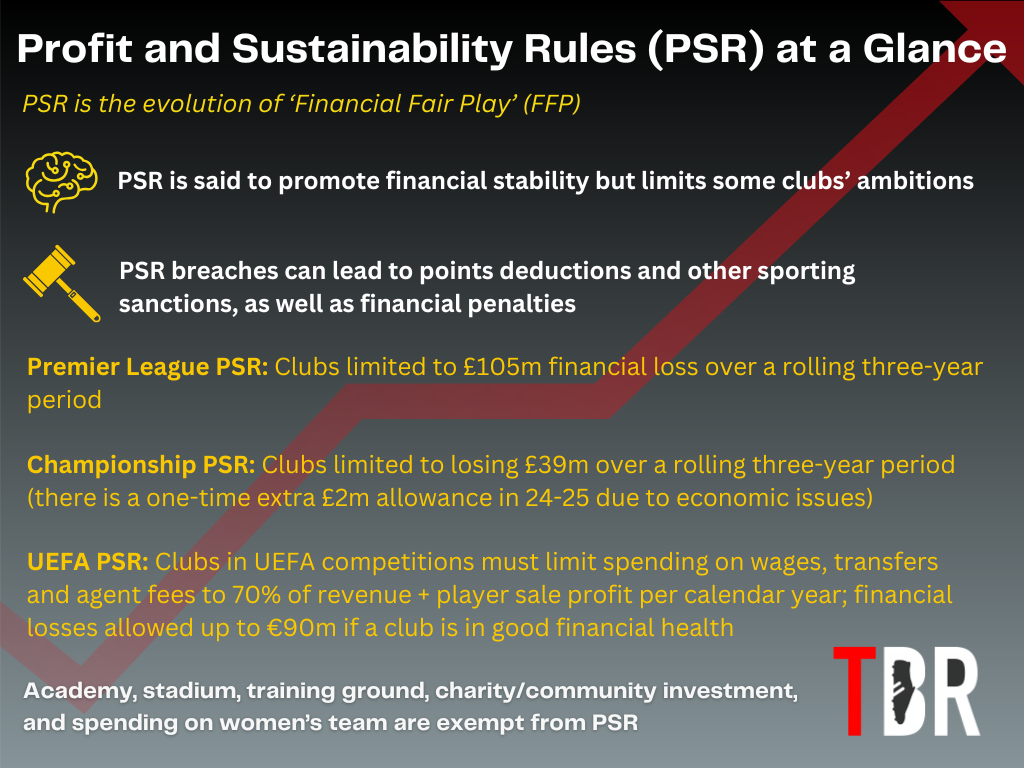

In 2025, most club owners are now trying to bring inflation under control again, though there are several noteworthy exceptions in the likes of Newcastle United and Aston Villa. To meet sky-high costs and comply with Profit and Sustainability Rules (PSR), clubs are turning to matchday income once more.

Arsenal are one of the growing number of sides who have either recently expanded, are in the process of doing so, or are planning an expansion. Co-chair Josh Kroenke explained the Gunners’ ambitions to add 20,000 seats to the Emirates Stadium last summer and the plans have since gathered pace.

TBR Football understands that the club has been presented with preliminary conceptual designs and Stan Kroenke’s Kroenke Sports & Entertainment are considering finance options.

That last point is crucial, though. While Stan Kroenke is high on the Bloomberg Billionaires Index, billionaires rarely use their own cash reserves for projects like this, especially when the cost will be borne by the club, not the owner.

So what option will Arsenal, who owe over £300m to their owner already, choose to take? TBR Football spoke to football finance guru Kieran Maguire for his analysis.

Arsenal likely to use ‘bullet loan’ to pay for Emirates Stadium expansion, says finance expert

Early projections suggest that a complex build like the one in the post at the Emirates will demand at least £500m in construction costs.

Arsenal are expected to be forced to build upwards, not downwards as has been the case with many modern stadium builds. That increases expenses, with the seats highest up simultaneously costing the most while generating the lowest ticketing income.

For their £852m financing package, Tottenham managed to borrow most of the money at fixed interest rates of 2.5-3.5 per cent from the US private bonds market.

| Loan/bond | Principal | Interest rate |

| 1. Long-Term US Bonds (2019) | £525m | 3.3% |

| 2. BofA Loan (Remaining from 2019) | £62m | ~4.4% (floating) |

| 3. BofA Extension (2023) | £19m | ~6.3% |

| 4. Long-Term US Bonds (2021) | £250m | 2.83% |

Those were very favourable interest rates which until recently looked unachievable in the present day. However, the Bank of England’s decision to slash rates for the third time in a row has inspired some optimism among clubs about access to cheaper debt to build stadiums.

However, Kieran Maguire, who is a lecturer in football finance at University of Liverpool and host of the Price of Football podcast, doesn’t think the rate cuts will have much impact on Arsenal.

“Interest rates might make a difference in the short term but this is a long-term capital expenditure project,” he told TBR Football.

“If you take a look at what is happening in the long-term bond markets, we’re not seeing the same cuts that we are in the short-term rates, which is effectively being determined by the Federal Reserve in the United States and the Bank of England here.

“Spurs borrowed money at 2.5 per cent at a time of economic serenity on a global basis. Even though interest rates are being cut, that’s to boost the economy.

Credit: Adam Williams/TBR Football/GRV Media

“Now, there is uncertainty in terms of global trade, which makes the markets nervous. That is reflected in longer term interest rates, which I don’t think will fall on a sustained basis. For Arsenal, that means they won’t be able to borrow as cheaply as Spurs.

“For short-term projects, yes, there could be a benefit to lower interest rates. But the stadium project is likely to be a ‘bullet loan’, which is interest-only until the capital repayment.

“Even then, the chances are that it will get rolled over. If you’re a good and regular payer, why would the bank want to go and find another borrower?

A bullet loan is like an interest only mortgage. You borrow £100,000, you buy a house, you pay interest on that, then after 25 years the bank says they want their money. In theory, you have either taken out an insurance policy or saved up enough money or you’re screwed.

“For football clubs like Arsenal, it’s less of an issue because you have regular revenues. If there is going to be a long-term infrastructure investment at Arsenal, it will need a lot of funding and a long-term repayment date.”

- READ MORE: Arsenal’s Declan Rice responds when asked to describe Tottenham Hotspur using just one word

Arsenal’s £500m stadium plan could impact PSR

Under the Premier League and UEFA’s PSR/FFP systems, spending on infrastructure development is exempt from a club’s calculation during the construction phase.

However, once the asset is operational, interest cost count towards spending limits.

Usually, the extra revenue generated by, in this case, the new stadium is more than enough to significantly outweigh the negative impact of interest and cash flow and PSR.

It does, however, mean that Arsenal need to approach their search for finance carefully. At the moment, they have no PSR issues, but it might not always be that way.

Luckily, Stan Kroenke is well versed in this department. He pulled off arguably the most complex debt financing deal in stadium construction history when he raised over £5bn to build the SoFi Stadium in LA.

| Stadium | Cost (adjusted for inflation) | Location | Opened |

| SoFi Stadium | $5.5 billion | California, USA | 2020 |

| MetLife Stadium | $1.99 billion | New Jersey, USA | 2010 |

| Allegiant Stadium | $1.90 billion | Nevada, USA | 2020 |

| Wembley Stadium | $1.85 billion | London, UK | 2007 |

| Yankee Stadium | $1.79 billion | New York, USA | 2009 |

| AT&T Stadium | $1.79 billion | Texas, USA | 2009 |

| Mercedes-Benz Stadium | $1.56 billion | Atlanta, USA | 2017 |

| Singapore National Stadium | $1.41 billion | Kallang, Singapore | 2014 |

| Tottenham Hotspur Stadium | $1.33 billion | London, England | 2019 |

| Optus Stadium | $1.17 billion | Perth, Australia | 2017 |

That project, as well as the redevelopment of Ball Arena in Denver, will inspire optimism that KSE will get the best possible deal for Arsenal as they look to expand the Emirates.