Football has an exit problem. Daniel Levy, who values Tottenham at £3.75bn, is chairman and co-owner of one the few clubs who make a cash profit every year. Yet still, Spurs are struggling to find a buyer.

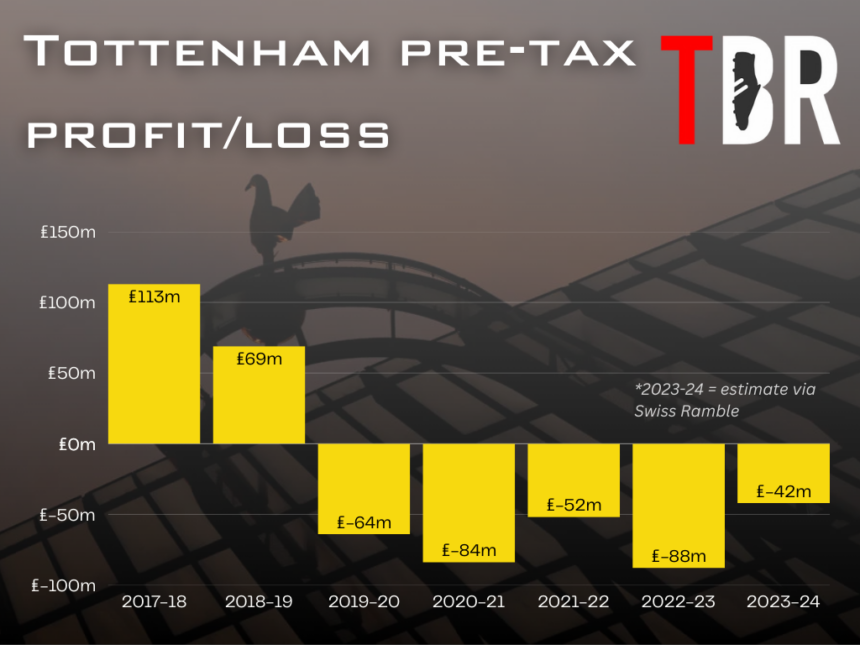

On paper, Tottenham have lost £288m since they moved into their new stadium in 2019. But there is a saying in football finance that reveals the truth: revenue is vanity, profit is sanity, but cash is reality.

A club’s ‘profit’ or ‘loss’ is not in fact a measure of how much money is flowing in and out of Daniel Levy business, which has probably the best underlying financial metrics of any Premier League club.

Photo by Richard Heathcote/Getty Images

Instead, the £288m they have ‘lost’ since the move away from White Hart Lane includes non-cash items like player transfer amortisation and, most significantly in Spurs’ case, depreciation.

The depreciation charge on the Tottenham Hotspur Stadium is around £70m per year, but that is a useful fiction to write down the cost of the asset over its lifetime. It’s not a cash cost.

This is the reason why the North Londoners have zero issues with Profit and Sustainability Rules (PSR), either under the Premier League or UEFA’s formulation.

Even in a bad year – and 2024-25 under Ange Postecoglou is proving exactly that – Spurs will generate a cash surplus, unlike many of their peers in the Premier League who require equity funding or loans.

Commercially, ENIC’s club goes from strength to strength, even if the same can’t be said about things on the pitch.

| Position | Team | Played MP |

Won W |

Drawn D |

Lost L |

For GF |

Against GA |

Diff GD |

Points Pts |

| 11 | 28 | 10 | 9 | 9 | 36 | 33 | 3 | 39 | |

| 12 | 28 | 11 | 5 | 12 | 48 | 44 | 4 | 38 | |

| 13 | 28 | 10 | 4 | 14 | 55 | 41 | 14 | 34 | |

| 14 | 28 | 9 | 7 | 12 | 34 | 40 | -6 | 34 | |

| 15 | 28 | 7 | 12 | 9 | 31 | 35 | -4 | 33 |

Sponsorship, merchandise, and events are extraordinarily lucrative to Spurs. They have capitalised on the prestige the new stadium has given them with a best-in-class commercial and brand building operation.

Meanwhile, they have shown more control of the wage bill than any other club in the Premier League, where there has been an arms race in terms of recruitment and retention thanks to soaring TV cash.

Of course, these aren’t the metrics that matter to fans. The opposite, in fact. But they are, in theory, what should make Tottenham so attractive to investors.

Photo by James Gill/Danehouse/Getty Images

Levy’s valuation of the club is said by some to be slightly high, though most agree it is not wildly over the top, especially when one considers what Ineos and Clearlake have paid for Man United and Chelsea.

In terms of compound growth, Spurs looks like a better investment opportunity than almost any other asset class in business. Enterprise value has increased by an average of 16 per cent annually since 2010.

But things seem to have ground to a halt in terms of ENIC’s search for fresh investment, whether in the form of a full or partial takeover.

CREDIT: Adam Williams / GRV Media

Amanda Staveley has been linked with minority investment, while unnamed private investors from Qatar are also said to be interested.

But rather than the beginning of the end that many fans hoped for when Levy announced the search for investment in April last year, we many not even be at the end of the beginning.

Despite the lack of trophies, easily the nadir of the ENIC era so far has been the European Super League debacle in 2021, when only the collective will of fans in N17 and beyond prevented the breakaway plot.

| Club | Major honours since Tottenham last won a trophy |

| Man City | Premier League (8), FA Cup (2), League Cup (6), UEFA Champions League (1), Super Cup (1), Club World Cup (1) |

| Man United | Premier League (4), FA Cup (2), League Cup (4), UEFA Champions League (1), Club World Cup (1), UEFA Europa League (1) |

| Chelsea | Premier League (3), FA Cup (4), League Cup (1), UEFA Champions League (2), Europa League (2), Super Cup (1), Club World Cup (1) |

| Liverpool | Premier League (1), FA Cup (1), League Cup (3), UEFA Champions League (1), Super Cup (1), Club World Cup (1) |

| Arsenal | FA Cup (4) |

| Leicester City | Premier League (1), FA Cup (1) |

| Wigan | FA Cup (1) |

| Portsmouth | FA Cup (1) |

| Birmingham | League Cup (1) |

| Swansea | League Cup (1) |

| West Ham | Conference League (1) |

If they had pulled it off, the enterprise value of Spurs would have skyrocketed overnight, with bigger profits and revenue streams guaranteed in a closed-shop, US franchise sport-style league.

The financial volatility of the Premier League and European football – where the Champions League can be make or break – makes it less appealing to investors than the NFL, NBA and MLB in the US.

Credit: Adam Williams/TBR Football/GRV Media

But now, in the culmination of a process that started almost as soon as the Super League was aborted, the competition is back.

Could Spurs be tempted, in contrast to their official position? TBR Football spoke exclusively to Liverpool University football finance for his take.

Tottenham secretly in favour of new Super League plot, says finance expert

In December last year, A22 Sports Management, the company backed by Real Madrid president and Daniel Levy crony Florentino Perez, unveiled their plans for Super League 2.0.

This time, the proposal is for a wider league system with promotion and relegation from domestic competition and, ostensibly, more equitable financial distribution mechanisms.

Last week, A22 CEO Bernd Reichart said he has spoken to 10 English clubs about the possibility of joining up, with many purportedly keen on the idea given the £2.7bn in prize money they think they can offer.

Could Tottenham be among them? “Privately, they will be in favour of Super League,” says Maguire, host of the Price of Football podcast.

“They are 13th in the Premier League. Under A22’s proposal, they can offer them almost guaranteed participation in the Star League [the top league of the revised format] each year.

“While it won’t be a closed shop in formal terms, it will effectively be in the sense that the Premier League is a closed shop for all intents and purposes.

Credit: Adam Williams / GRV Media / TBR Football

“A bad season for Spurs in the Premier League is finishing 12th or 13th and a bad season in the Star League will be similar, but they are unlikely to be relegated from either league.

“That is different from the Champions League, where you can be in it one season and not the next, with a huge swing in revenue as a result.”

Spurs and ENIC can’t afford another PSR disaster

Either late this year or early next, the government will bring an independent football regulatory into law.

The regulator, which is making its way through Parliament, is expected to have the power to block clubs from joining breakaway competitions.

“Spurs will say one thing in private and another in public,” says Maguire on the Super League plans in light of the regulator, “but from an optics point of view they can’t be seen to be coming out in favour of this.

“Unless there is a major change in public opinion and the regulator’s position, they can’t be seen to be extolling its virtues, but it would help to de-risk the Champions League issue in terms of revenue volatility.

“It may be that this is simply a ploy to extract more money from UEFA.”

- READ MORE: Tottenham interested in bringing back former academy star who Jose Mourinho called ‘quality’

The latest on Daniel Levy’s search for takeover or new investment

While they only went public with the news in April 2024, ENIC and Levy have been looking for fresh investment for several years.

Previously, Spurs held talks with Todd Boehly and Jonathan Goldstein before they invested in Chelsea.

The private equity firm MSP Sports Capital and new Everton owner Dan Friedkin were also interested at one point.

| Name | Rank in top 500 | Net worth | Club(s) |

| Bernard Arnault | 4 | $189B | Paris FC |

| Mark Mateschitz | 80 | $23.4B | Red Bull clubs |

| Stan Kroenke | 85 | $22.8B | Arsenal, Colorado Rapids |

| Philip Anschutz | 86 | $22.8B | Los Angeles Galaxy |

| David Tepper | 87 | $22.4B | Charlotte FC |

| Francois Pinault | 90 | $22.1B | Stade Rennais |

| Dietmar Hopp | 112 | $18.4B | 1899 Hoffenheim |

| Jim Ratcliffe | 200 | $12.4B | Man United, Nice, Lausanne |

| Hansjoerg Wyss | 218 | $11.9B | Chelsea, Strasbourg |

| Josh Harris | 224 | $11.7B | Crystal Palace |

| Simon Reuben | 227 | $11.5B | Newcastle United |

| David Reuben | 228 | $11.5B | Newcastle United |

| Dmitry Rybolovlev | 246 | $11.1B | AS Monaco |

| Mark Walter | 252 | $10.9B | Chelsea, Strasbourg |

| Dan Friedkin | 253 | $10.9B | AS Roma, AS Cannes, Everton |

| Shahid Khan | 307 | $9.33B | Fulham |

| Nassef Sawiris | 324 | $8.95B | Aston Villa, Vitoria |

| Daniel Kretinsky | 402 | $7.69B | West Ham, Sparta Prague |

| Joe Lewis | 405 | $7.66B | Tottenham |

| Todd Boehly | 426 | $7.28B | Chelsea FC, Strasbourg |

While the structure of any potential deal isn’t clear, Paris Saint-Germain owners Qatar Sports Investments have engaged with the club too. Their president, Nasser Al-Khelaifi, is a close ally of Levy.

Amanda Staveley meanwhile, who is said to have raised £500m for her next investment project, confirmed she was in talks with a Premier League club following her exit from Newcastle United last summer.

Though she stopped short of naming Spurs – probably because of an NDA – it is clear that the North Londoners are in her sights.

But with the regulator issues still to shake out, macroeconomic conditions unfavourable, and Levy’s negotiating style to navigate, don’t expect an announcement any time soon.