Unlike with FSG investments in US franchise sport, it will be the Liverpool players, not the owners, who first get their hands on the Premier League trophy when the ceremony takes place.

That’s as it should be. It’s Mohamed Salah, Virgil van Dijk, Trent Alexander-Arnold and Alexis Mac Allister whose talents have secured the title, not John Henry, Tom Werner and Mike Gordon.

But FSG will take the plaudits in the football finance community – and with good reason.

Arne Slot has proven to be an inspired appointment to replace the seemingly irreplicable Jurgen Klopp, first and foremost.

Michael Edwards’ return to the FSG setup and the owners faith in the existing squad while most Liverpool fans were demanding retail therapy in the transfer market meanwhile have been masterstrokes.

In the summer, Liverpool will surely spend big. They have a brilliant but aging squad and a succession plan is being laid behind the scenes at Fenway’s head office in Boston.

That’s the industry that FSG have invested in. The Premier League is as unforgiving on the balance sheet as it is on the pitch. Clubs need to run to stand still.

On the other side of the Atlantic, it’s not quite as relentless.

| Company or team | Industry/league |

| Liverpool F.C | Premier League |

| Boston Red Sox | Major League Baseball |

| Pittsburgh Penguins | National Hocket League |

| RFK Racing | NASCAR Cup Series |

| PGA Tour | US professional golf |

| GOAL | Fitness and training app |

| Hana Kuma | Naomi Osaka’s Media company |

| SpringHill | LeBron James’ entertainment firm |

| Boston Common Golf | TGL Golf League |

| Fenway Sports Management | Sports marketing and consulting |

| Fenway Music Company | Music and live events |

Systems exist to ensure that teams in Major League Baseball and the National Hockey League almost always turn a profit, regardless of their sporting performance.

That’s why, despite having much smaller revenues, MLB and NHL franchises are worth significantly more on average than Premier League teams.

FSG-owned Pittsburgh Penguins, for example, turned over £166m in the last financial year, which was less than Brentford. Yet the Penguins are worth around £1.3bn, while Brentford are valued at £400m.

Their investment at Anfield, however, is a different proposition. Liverpool will have earned upwards of £700m by the end of 2024-25. That is reflected in their enterprise value.

On face value, the Merseysiders lost £77m over the last two financial years.

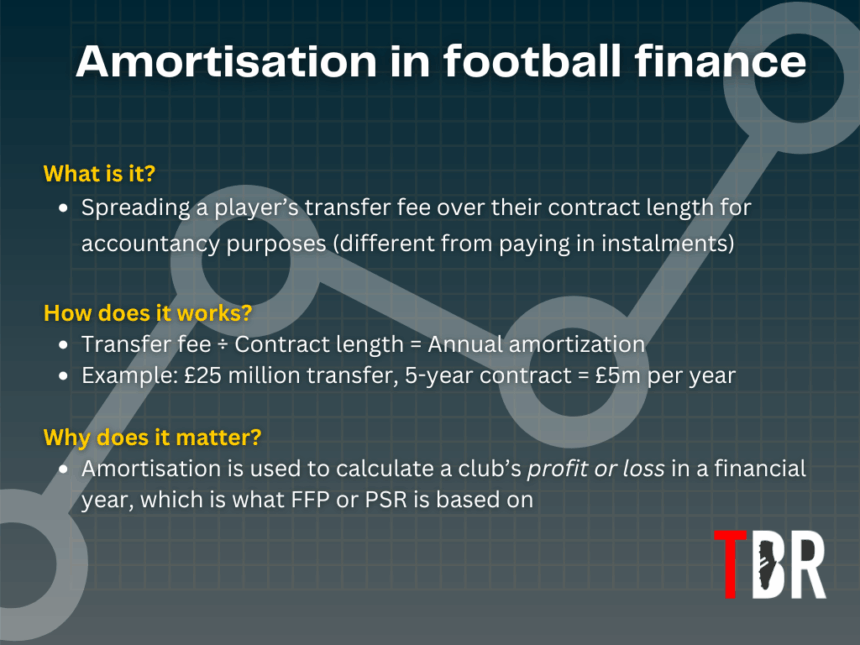

But accountancy is weird and, when you strip out non-cash expenses like depreciation and amortisation, they have actually just about broken even in that stretch.

Credit: Adam Williams / GRV Media / TBR Football

And when FSG do sell Liverpool – which is the long-term plan under their capital appreciation model – they are in for the mother of all paydays.

The owners control one of the most valuable sports empires in the world and, if their investors are right, the graph only trends up and to the right.

Liverpool owners FSG’s portfolio soaring in value

Valuing sports teams isn’t an exact science but it’s especially hard in football.

If you buy an ‘asset’ like Liverpool, you’re basing your investment less on the profits it generates now and more on its potential for the future.

FSG think that the club’s global appeal and intellectual property can be better monetised. Developments in technology, media rights, retail and the matchday experience, they believe, can unlock far more upside.

The owners’ two other major sports investments – the NHL’s Pittsburgh Penguins and MLB’s Boston Red Sox – arguably have more limited growth potential.

However, that isn’t to say there isn’t room for improvement.

As relayed by Sports Business Journal, Doc O’Conner – who is a proxy investor in Liverpool via Arctos, who own a five per cent stake in FSG – has said: “Don’t sleep on Major League Baseball.”

“There are likely to be wholesale reform on an economic basis across Major League Baseball, which makes growth opportunities really, really strong in that league.

“They [MLB franchises] are most exposed to many of the challenges in the media ecosystem that all sports are facing, but I think that their view of those challenges as opportunities is an interesting one.”

At present, most analysts say the Red Sox are valued at around £4.25bn despite having underperformed in recent seasons. That’s almost exactly the same as Liverpool, who Forbes appraise at £4.3bn.

Credit: Adam Williams/TBR Football/GRV Media

A rising lifts all boats. A more valuable FSG empire will create more stability, which in turn will allow the owners to ringfence more funds for Liverpool.

For context, Arctos are a sports-focused private equity firm.

As well as their indirect investment in Liverpool, they acquired a 12.5 per cent stake in Paris Saint-Germain in a deal that valued the club at around £3.7bn in 2023. They also hold a minority stake in Atalanta.

- READ MORE: Trent Alexander-Arnold to stay on FSG owners’ payroll even if he quits Liverpool for Real Madrid

When will FSG sell Liverpool?

In 2022, FSG invited offers for Liverpool.

It wasn’t the first time they had considered selling the club, though this was the first time they had actively courted bids.

In the end, they decided against it, partly because Manchester United’s sale process fragmented the market and didn’t inspire optimism that they could get their asking price.

And in 2023, they sold a minority stake to Dynasty Equity. It was about three per cent and was worth £127m, which is almost half of the £300m they paid for 100 per cent of Liverpool in 2010.

Credit: Adam Williams/TBR Football/GRV Media

That’s an annual compound growth rate of around 20 per cent, which is better than just about any other asset class out there.

Until Liverpool can demonstrate real, long-term profitability or something seismic happens with media rights or technology, it’s unlikely that rate will continue.

The European Super League – which FSG personally co-masterminded – was meant to be that breakthrough moment, but its collapse meant they had to change course.

Now, it seems like there will be more a slow-burn approach.

Revenue will continue to climb and, FSG will hope, tighter Profit and Sustainability Rules (PSR) will slow inflation in the transfer and wage market, as well as acting as an anchor for state-backed competitors.

That will take time to crystalise. FSG won’t be selling Liverpool any time soon.